Frequently asked questions

Find answers to many commonly asked questions about The Perth Mint including orders, accounts, buying and selling gold and other precious metals, and many other topics.

General

We answer your questions about products and other general enquiries.

- What do I need to know about guest checkout?

- Can you tell me if my gold bar is authentic?

- Is The Perth Mint aware of fake websites?

- Can I report suspicious or fake websites impersonating The Perth Mint?

- How often does the Perth Mint Spot Price update?

- Can I sell my old gold and silver jewellery at The Perth Mint? What if I am interstate?

- Are you open on public holidays?

- Who do I contact about order enquiries?

- How can I buy jewellery from your boutique?

- Do you buy gold jewellery?

- Is GoldPass a legitimate Perth Mint product?

- If banks go into insolvency does it impact The Perth Mint’s accounts?

- Are there any government clauses that can seize cash or bullion stored with The Perth Mint in the event of financial collapse?

- What is your accessibility policy for your website?

- Do I have to pay Australian GST on my purchases?

- Do I have to pay local taxes on my purchases if they are more than AUD 300 and I live in the European Union or UK?

- What payment methods can I use and how long will it take for payment to clear?

Shipping

We answer your questions about shipping and delivery.

- Can my order be delivered to a PO box or any other unattended location?

- Will my parcel be left unattended if no one is there when to meet the carrier?

- I have a roadside mailbox, does this affect me?

- Will I get postal correspondence delivered to my PO box or unattended location?

- Do you ship to every country? Are there any countries you do not ship to?

- What is the minimum order for customers based in European Union member countries and the UK?

- If I live in a European Union country or the UK and want to buy goods to send outside these regions, does the AUD 300 threshold still apply?

- Does the minimum threshold of AUD 300 apply if I live outside the European Union and the UK but I want to send my purchase to an address within these regions?

Bullion

This information will help you understand more about buying bullion and your bullion account requirements.

- What countries can I buy bullion from? Is there a limit to the amount I can order?

- How do I buy bullion?

- Do I need an account to buy bullion? What documents are required for the verification process?

- Is my order covered by insurance?

- How do I apply for a credit account?

- How much bullion can I buy on credit card?

- What is a Contract Completion Guarantee (CCG)?

- How often does the bullion price update?

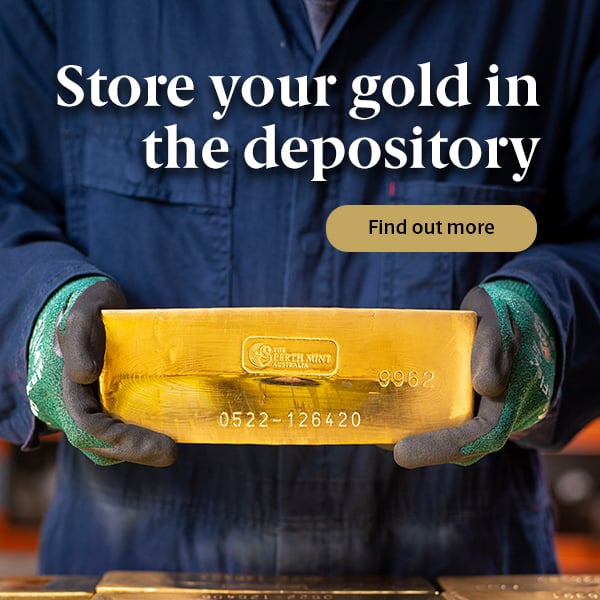

Storage

Find answers to your questions about storing gold, silver and platinum in The Perth Mint Depository.

- How does the government guarantee apply to the depository?

- How secure are The Perth Mint’s vaults and operations?

- Can I deposit metal bought elsewhere my metal into your storage facility?

- Can you advise me on investing in precious metals?

- Why is there no storage fee for unallocated precious metals?

- What risk is there of insolvency?

- What is the mint’s policy on use of unallocated metal?

- Does usage of the unallocated metal by the mint affect my ability to collect physical metal?

- Can I convert between storage types?

- Can I view or audit my metal?

- The government guarantee only mentions gold, does that mean my silver and platinum deposits are not covered?

- Does the phrase ‘cash equivalent’ in the government guarantee mean that I am not guaranteed to receive physical metal?

- My loved one has passed away and had a Depository account, what should I do about the deceased estate?