The Perth Mint celebrates past, invests in future

The Perth Mint has signed off on a year in which it marked 125 years of unbroken operation in Western Australia and continued a major program of investment that sets the business up for the future.

A period dominated by a record high gold price and weak global economic conditions as well as significant investment in the business resulted in the Mint reporting a before tax loss of $15.54 million for the year to 30 June 2024.

After four years of unprecedented global demand experienced by mints around the world, global sales of minted products have returned to pre-pandemic levels.

The Mint spent the past year adjusting the organisation for a return to lower demand and more sustained market conditions.

Contributing to the full-year result was significant expenditure on major items including ongoing work on the Mint’s $34 million AML remediation program and a $12 million provision for future state batteries remediation work.

Excluding these extraordinary items, the Mint returned an operating profit before tax of $6.94 million.

The Perth Mint CEO Paul Graham acknowledged the full-year loss but said it was important that the organisation was investing now for sustained, future success.

“I am confident we have made the necessary changes required, including adjusting our organisation to return to more normalised market conditions, to put the Mint in a healthy position for the next financial year and beyond,”

“While recent years have been incredibly rewarding financially, they were also an anomaly and the result of the unforeseeable external factors such as the pandemic and geopolitical instability.

“What we are experiencing now is a return to more normal market conditions and we have adjusted our operations accordingly while continuing to invest in the modernisation of our systems and production processes.

“We are proud to be marking our 125th anniversary this year, an extraordinary milestone for a business that has supported the Western Australian gold industry from the beginning.

“Our focus on modernisation means we can continue to be a strong partner for decades to come.”

Mr Graham said he was pleased by significant improvements in workplace health and safety with the Mint’s Total Recordable Injury Frequency Rate reducing to 7.22, down from 13.42 just one year ago.

“This is a testament to the hard work of everyone here at the Mint and I thank them for prioritising the wellbeing of our team,” he said.

The Mint’s refinery processed 18.36M ounces of gold and silver doré, up from 15.99 million ounces in 2022-23. The refinery processed approximately 75% of the newly mined gold doré produced in Australia in 2023-24, underscoring the crucial role the Mint plays as the gold mining sector’s partner of choice.

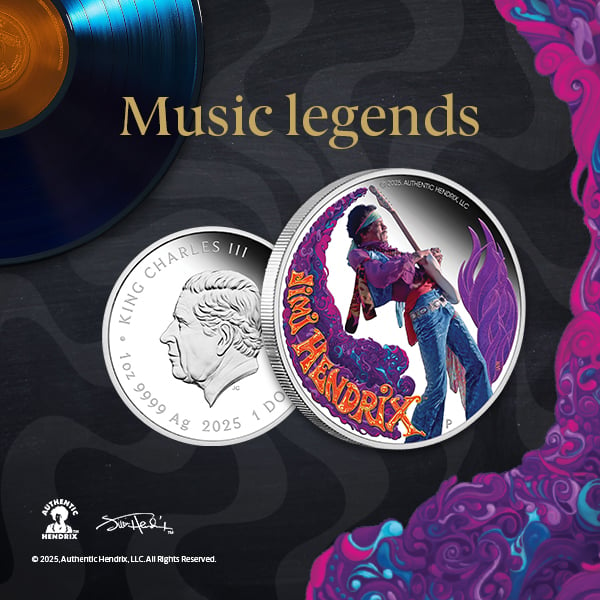

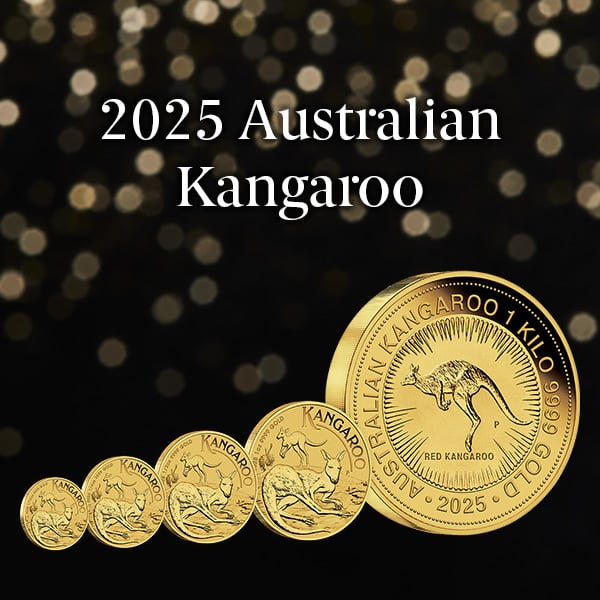

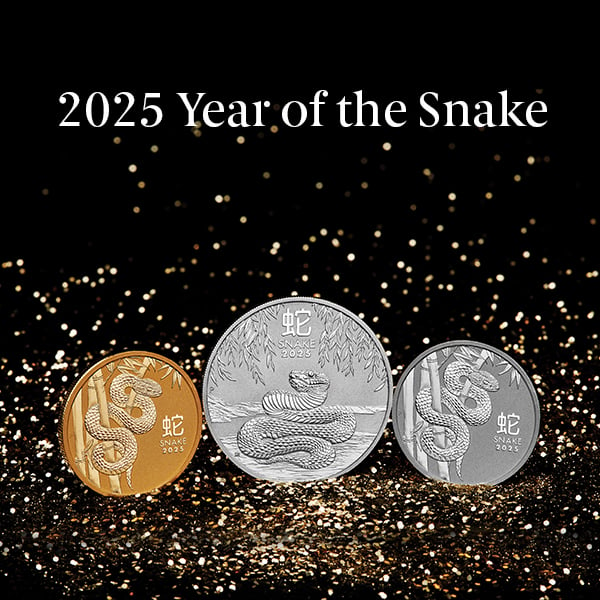

The Perth Mint sold 8.59 million of its exceptional quality collector and investor coins, medallions and minted bars which are all designed and crafted in Perth. In line with the experience of mints around the world, the Mint recorded a significant fall in demand as the record high price of gold made these products more expensive.

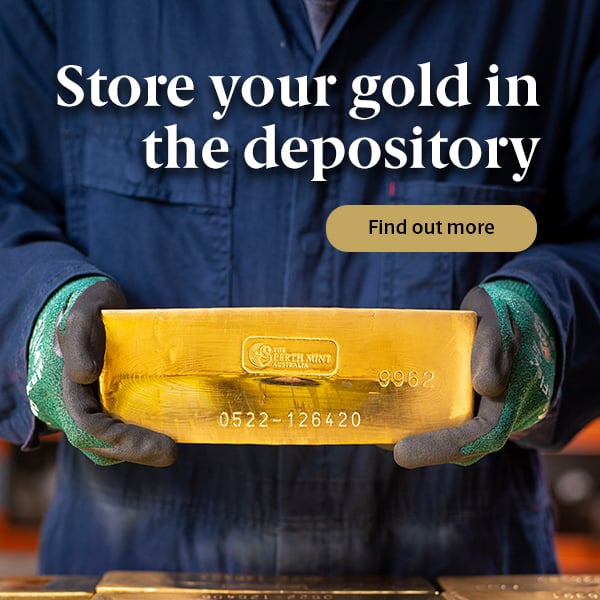

As at 30 June 2024, the value of precious metal in the Mint’s depository holdings increased to $7.3 billion from $6.4 billion over the course of the year driven by the record gold price. During the year, some depository customers capitalised on the high gold price environment to liquidate some of their holdings, with the volume of precious metals held in the Mint’s secure storage facilities at 30 June 2024 down 8.13% per cent year-on-year.

Visitor numbers to the Mint’s gold tour in its heritage East Perth location rose to their highest since 2006, with 82,883 visitors through the doors, up from 78,910 the previous year.

2023-24 AT A GLANCE

Revenue – $25.37 billion

Operating profit before tax – $6.94 million (excluding ALM Remediation Program and state batteries)

Annual loss before tax – $15.54 million

Workforce – 749 individual employees

Lost Time Injury Frequency Rate (LTIFR) – 1.61

Total refining volume – 18.36M ounces of gold and silver doré.

Global sales – 8.59 million collector coins, medallions and minted bars sold

Client investments - $7.3 billion of client metal on deposit at 30 June 2024

Visitors to The Perth Mint Gold Tour – 82,883

View The Perth Mint’s entire range of precious metals products and more at perthmint.com and connect on Facebook, LinkedIn, Twitter and Instagram.