Silver demand rebounds as gold price hits new highs

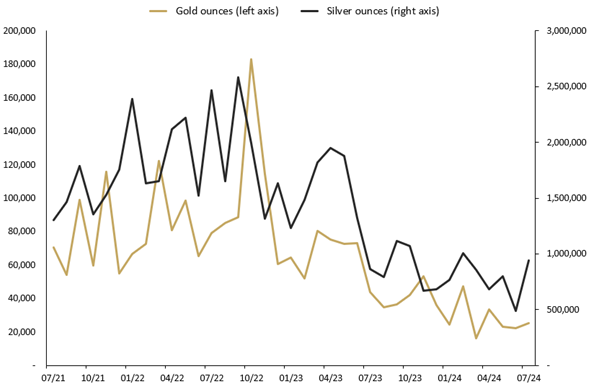

The Perth Mint sold 25,457 troy ounces (oz) of gold and 939,473 oz of silver in minted product form during July 2024.

Opening the month around USD 2,340, the gold price tracked higher, until it hit a record high of USD 2,483.60 on 17 July (US time).

The price rise was driven by several factors, including renewed geopolitical concerns in the Middle East, which increased demand for safe haven assets, and momentum buying in the market once gold broke through some resistance barriers.

In addition, on 11 July we saw a positive US consumer price index result for the month of June where the annual headline CPI rate fell to 3%. This renewed expectations of a September interest rate cut in the US.

Over the subsequent week, gold dropped by about USD 100, primarily driven by reported weak physical demand from China. However, at the end of the month gold was trading back above USD 2,400 for a 4% gain in July.

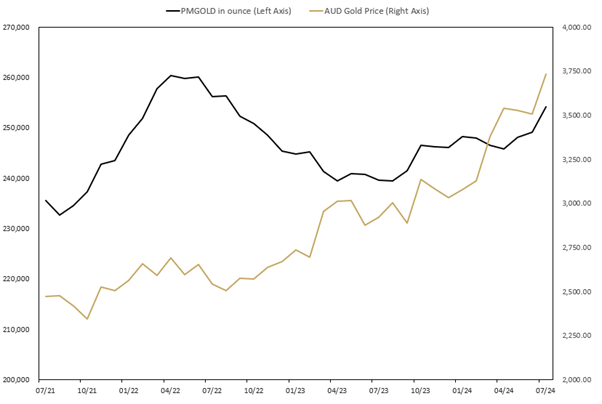

In Australian dollar terms, the gold price gained 6% for the month and also reached a new record high. It was supported by a weaker Australian dollar which fell over 2.5% against the USD during the month on concerns over the health of the Chinese economy and the impact of falling commodity prices.

Silver started the month trading around USD 29.25 and then tracked higher to around USD 31 before dropping sharply to finish the month around USD 28.50, a near 2.50% drop in July. Gold was supported by flight to safety concerns, but this did not support the silver price and silver was also impacted by a steep decline in the copper price during the month.

The silver price in Australian dollar terms for the month of July was only slightly lower as the drop in USD price was offset by the weaker Australian dollar.

The Gold Silver Ratio was 84.40 at the end of July increasing because of outperformance of gold during the month.

Minted products

The Perth Mint sold 25,457 oz of gold and 939,473 oz of silver in minted product form during July.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious Metal

Current Month

1 month %

3 months %

12 months %

Gold

25,475

13%

-24%

-42%

Silver

939,473

91%

37%

9%

JULY 2024 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, welcomed the strong silver result and the improvement in gold sales from the previous month.

“We had a particularly robust month for silver sales in the United States, which is our biggest market,” Mr Vance said.

“And we saw a strong response to two key silver coin releases, the 1oz Rectangular Dragon coin, and the Next Generation Australian Emu 2oz coin.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in July 2024

- Dragon 2024 1oz Silver Rectangular Bullion Coin (individual and in tube)

- Dragon 2024 1oz Gold Rectangular Bullion Coin

- Next Generation Australian Emu 2024 10oz Silver Piedfort Bullion Coin (previously mother and baby)

- Next Generation Australian Emu 2024 2oz Silver Piedfort Bullion Coin (individual and in tube)

For more new product information visit the bullion web page.

Bullion coins recently ‘sold out’ at The Perth Mint

- 2023 Australian Brumby 1oz Silver Bullion Coin

- 2024 Wedge-Tailed Eagle 1oz Silver Bullion Coin

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during July 2024. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

Perth Mint Gold (ASX:PMGOLD)

Total holdings in Perth Mint Gold (ASX:PMGOLD) increased during July by 5,136 oz (2.06%). This brings the holding in PMGOLD to 254,177 ounces (7.91 tonnes) the highest level in nearly two years.

Perth Mint Gold is an exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD web page. PMGOLD webpage.

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) JULY 2021 TO JULY 2024