Lunar Release a hit with customers driving strong sales at The Perth Mint

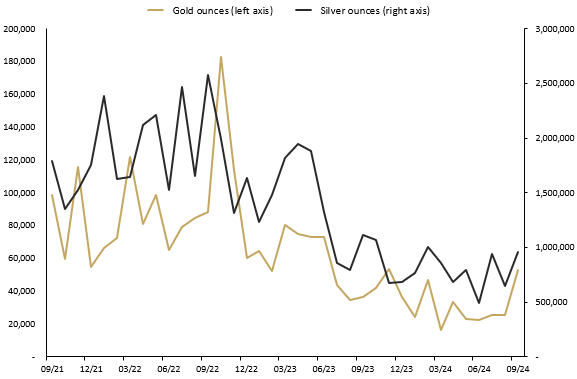

The Perth Mint sold 53,143 troy ounces (oz) of gold and 963,198 oz of silver in minted product form during September 2024.

Opening the month around USD 2,500, the gold price traded in a narrow band around this level before charging to record a number of all-time highs. This was driven by factors including rate cut expectations, which drove technical buying and positioning, and reported official sector demand. Prior to the FOMC meeting gold gained for several trading sessions, but when a rate cut of 50bps was announced gold and other assets actually dropped slightly as the market assessed and reviewed the data. Once the data was digested however demand for gold rose, supported by increased geopolitical concerns. This prompted a second run, rising almost USD 100 over a number of trading sessions to record new all-time highs. At the end of the month gold was trading down from its elevated levels, hovering around USD 2,635 for a 4.50% gain in September with a year-to-date gain of close to 27.50%.

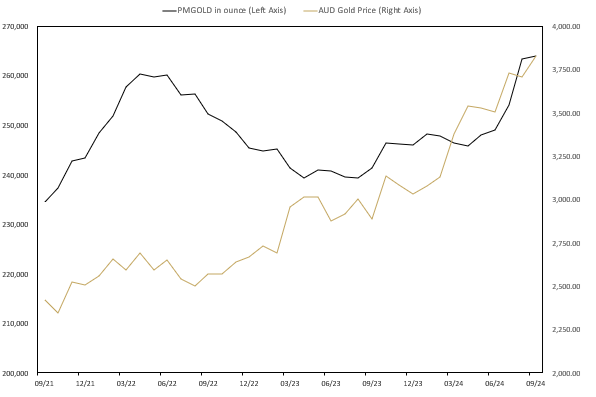

In Australian dollar terms, the gold price moved higher in September but did not gain to the same level as it did in USD terms. The strengthening AUD USD rate offset some of those gains. Additionally, late in the month China announced a number of measures to support its economy which resulted in gains for the AUD, hitting its highest level in more than 12 months. The local gold price briefly traded above AUD 3,900 in September but by end of the month the precious metal was trading a little above AUD 3,800 for a monthly gain of 3.00%.

Silver trended higher on most trading days in September supported by two factors. The first being the overall positive sentiment towards precious metals generally, and the second being the announcement of the economic supports in China. Intramonth silver traded at a 10-year high of near USD 32.50 before dropping slightly by end of the month to trade around USD 31.10, representing a 5.00% monthly gain and year-to-date more than 31.00%, outperforming gold.

The silver price in Australian dollar terms at the end of August was higher as the gain in USD price was offset by the strengthening Australian dollar.

The Gold Silver Ratio was above 84.55 at the end of September, decreasing because of outperformance of silver.

Minted products

The Perth Mint sold 53,143 oz of gold and 963,198 oz of silver in minted product form during September.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

53,143

105%

136%

45%

Silver

963,198

49%

96%

-14%

SEPTEMBER 2024 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, was delighted by the reception to the Australian Lunar Series III 2025 Year of the Snake collection which drove up Minted Products sales in September.

“Our lunar series is always eagerly anticipated by our customers and judging by sales alone, this year’s range has proved as popular as ever,” Mr Vance said.

“Designer Sean Rogers has done a magnificent job capturing the characteristics of the snake as expressed in lunar folklore and we look forward to releasing more from this range over coming months.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in September 2024

- Australian Lunar Series III 2025 Year of the Snake 2oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1/2oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1/10oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1/4oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 2oz Silver Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1oz Silver Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1/2oz Silver Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1oz Platinum Bullion Coin

- Australian Emu 2024 1oz Silver Bullion Coin

- Australian Emu 2024 1oz Gold Bullion Coin

For more new product information visit the bullion web page.

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during September 2024. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

Perth Mint Gold (ASX:PMGOLD)

Perth Mint Gold is an exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD web page. PMGOLD webpage.

Total holdings in Perth Mint Gold (ASX:PMGOLD) increased during September, with holdings increasing by 488 oz (0.19%). This brings total holdings in PMGOLD to 263,912 ounces (8.21 tonnes) continuing the recent growth in the product.

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) SEPTEMBER 2021 TO SEPTEMBER 2024