Perth Mint sees record gold sales in Q1 as precious metal prices continue to ease

Summary

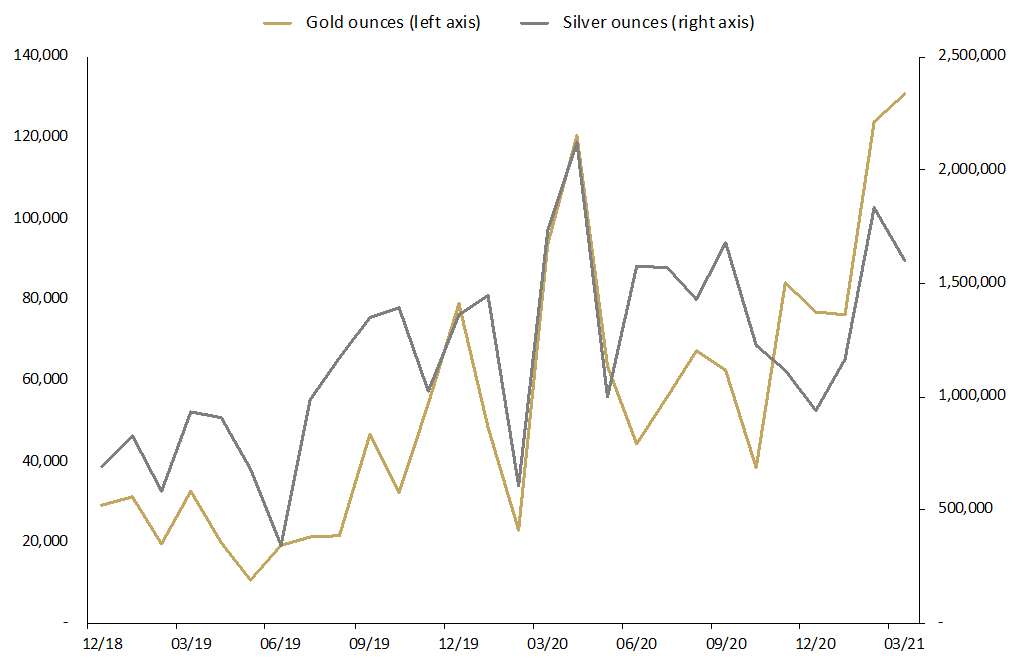

- Perth Mint minted product sales for both gold and silver remained strong during March, with more than 130,000 troy ounces of gold and almost 1.6 million troy ounces of silver shipped to clients worldwide. These figures are 285% higher (gold) and 178% higher (silver) than average monthly sales dating back to 2012

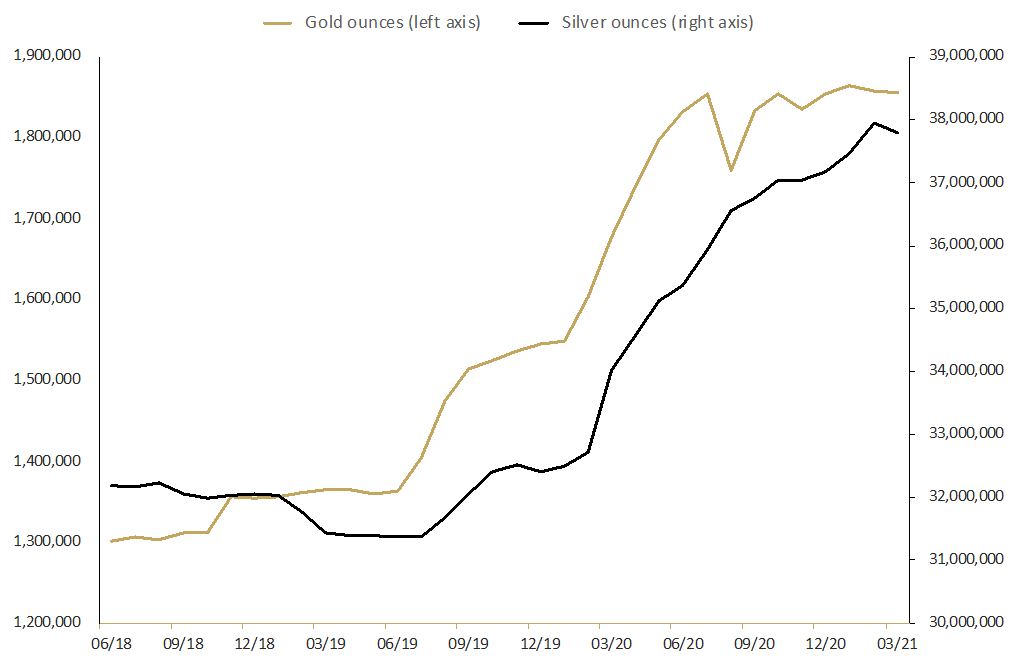

- Perth Mint Depository holdings of gold and silver remained flat during March, with total holdings for both metals 11% higher than they were one year ago.

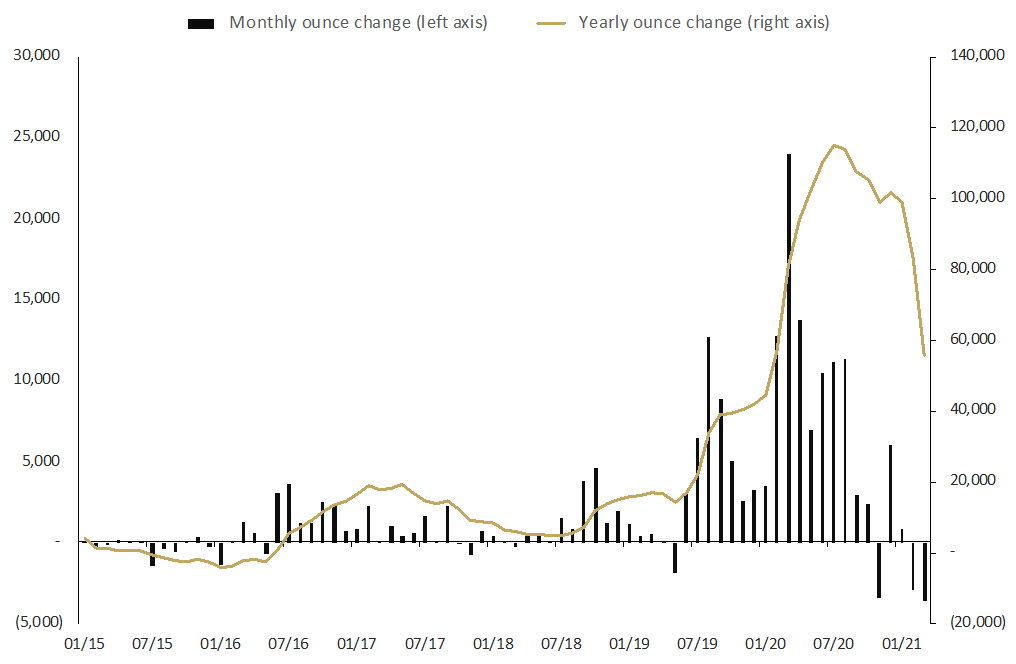

- Perth Mint gold ETF holdings declined by 1.5% in March, mirroring outflows seen across the global gold ETF market, which have seen total holdings drop by almost 9% since all-time highs seen in October 2020.

Commentary

Gold and silver prices continued to weaken in March, with the precious metals falling by 11% (gold) and 9% (silver) in the first three months of 2021.

There have been multiple factors contributing to the sell-off, which has now seen the US dollar gold price pullback by almost 20% since it hit all-time highs in August 2020. These factors include a rally in the US dollar, an increase in real bond yields (US 10 year Treasuries moved from -1.06% at end December 2020 to -0.63% at end March 2021), soaring prices for cryptocurrencies with Bitcoin trading near USD 60,000, up ten times in the last year, and continued strength in equity markets with the S&P 500 topping 4,000 points in early April.

Manager, Listed Products and Investment Research, Jordan Eliseo says, “The pullback in prices has led to a spike in demand for minted products. In Q1 2021, The Perth Mint sold more than 330,000 troy ounces of gold, and more than 4.5 million troy ounces of silver. These figures represent the highest calendar quarter on record for gold, and the fourth highest calendar quarter on record for silver.”

Minted Products

The Perth Mint shipped more than 130,000 troy ounces of gold coins and minted bars in March 2021, and almost 1.6 million troy ounces of silver. The sales figures represent a continuation of a strong period of demand for Perth Mint minted products, with calendar quarter gold sales their highest on record.

General Manager Minted Products, Neil Vance, reported that coin production in March took up where February left off. “The market continues to take everything we can make at present,” he said, citing above average demand in key markets such as the United States and Germany. “Production remains concentrated on our most popular 1oz Kangaroo coins and while we just about satisfied demand for gold this month, interest in silver is outstripping our capacity to convert plentiful supplies into finished goods.”

Troy ounces of gold and silver sold as coins and minted bars

December 2018 to March 2021

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala and Lunar series. For more product information visit perthmintbullion.com

The Perth Mint Depository

Holdings of both gold and silver in The Perth Mint Depository were largely flat in March 2021, ending the month at 1.854 million troy ounces (gold) and 37.8 million troy ounces (silver).

Despite the recent stagnation, total holdings of both gold and silver are up 11% in the last 12 months, with the emergence of COVID-19 and the fiscal and monetary policy response encouraging investors to add precious metal positions to their portfolios.

Total troy ounces of gold and silver held by clients in The Perth Mint Depository

June 2018 to March 2021

The Perth Mint Depository enables clients to invest in gold, silver and platinum, with The Perth Mint storing this metal in their central bank grade vaults. Operated via a secure online portal, a Depository Online Account allows investors to buy, store and sell their metal 24/7. For further information visit perthmint.com/storage.

The Perth Mint Depository enables clients to invest in gold, silver and platinum, with The Perth Mint storing this metal in their central bank grade vaults. Operated via a secure online portal, a Depository Online Account allows investors to buy, store and sell their metal 24/7. For further information visit perthmint.com/storage.

Perth Mint Gold (ASX: PMGOLD)

Holdings of Perth Mint Gold (ASX: PMGOLD) fell by 1.5% in March 2021, with the outflows seeing total holdings in PMGOLD decline to 230,279 troy ounces, or just over 7.15 tonnes.

Monthly flows for PMGOLD and the yearly change in total troy ounces can be seen in the chart below, with holdings rising by more than 55,000 troy ounces (+32%) in the last 12 months.

Monthly change in troy ounces held by clients in Perth Mint Gold (ASX:PMGOLD)

January 2015 to March 2021

Source: The Perth Mint, ASX, Reuters

Source: The Perth Mint, ASX, Reuters

The value of PMGOLD holdings also fell in March, ending the month just above AUD 510 million. Despite this decline, the value of gold holdings backing PMGOLD has risen by 13% in the last 12 months.

To learn more about investing in PMGOLD, download our PMGOLD Factsheet.