Outlook for gold shines on prospect of Fed pivot in 2023

The price of gold finished 2022 on a strong trajectory and with many analysts agreeing it has the potential to run higher in 2023, one of the easiest ways retail investors can secure immediate exposure to the precious metal is through a tried and trusted exchange traded product (ETP).

Looking back at 2022

Looking back at 2022, the price of gold experienced three distinct phases. The Ukraine invasion and surging inflation pushed gold prices higher during the opening three months of the year, with safe haven demand fuelling the strongest quarterly inflows to gold ETPs since 2020.

The solid start, however, softened from mid-April. Pressured by rising interest rates and the rocketing value of the US dollar, prices trended downwards with little reprieve until the beginning of November, with ETPs experiencing significant outflows in the process.

The turning point for gold arrived on 2 November when the US Federal Reserve hiked its benchmark rate by 75 basis points to 4%. With Chairman Jerome Powell appearing steadfast in his determination to target 2% inflation, the news increased investor jitters about a possible global recession.

In short, sentiment in the gold market turned positive, prices rapidly recovering losses to finish December at USD 1,812.35, up USD 3.30 on the year.

We now know that central banks also started buying up large amounts of gold and, coincidentally, pressure was heaped on gold-rival bitcoin with the collapse of FTX crypto exchange.

In unison with greater interest in gold, the rate of outflow from gold ETPs slowed. In December, North American funds became the first to register positive demand since April.

Will gold thrive in 2023?

In the big picture, investor interest in gold is dependent on a number of observations.

Historically, gold has had a negative correlation to stocks and other financial instruments, making it an effective portfolio diversifier.

While fiat currency is likely to lose purchasing power to inflation over time, the price of gold tends to rise along with everything else. Thus in periods of higher inflation, it’s viewed as a good store of value.

Gold has typically performed strongly in periods of financial market stress, making it a simple and effective hedge against market, geopolitical and event risk.

Furthermore, gold has provided good long-term returns. Using average closing prices, the price of gold rose from USD 279 in 2000 to USD 1,800 in 2022, providing an annual average gain of 8.8%.

The question now is, will the gold price trend seen in late 2022 continue during 2023? And one of the key factors to watch will be whether the Fed pivots on interest rates.

What is a Fed pivot?

A ‘Fed pivot’ occurs when the US central bank reverses its policy outlook and changes course, which in the current scenario would be from a contractionary (tight) to an expansionary (loose) monetary policy.

According to some experts, the Fed can rarely keep tight policy as long as it wants to because inevitably something will happen that threatens the stability of the financial system.

Already we have seen lower rate rises in order to relieve pressure on businesses and the markets. Because revised monetary policy usually takes weeks or months for its effects to be felt, some say an actual cut in interest rates in order to avoid a hard landing may be prudent sooner rather than later.

Analysts at Bank of America have said that should this occur, it’s likely a falling US dollar (in which gold is denominated) and treasury yields will encourage more investors to buy bullion across 2023.

BofA says the price could exceed $2,000 an ounce next year as of all the precious metals “gold has the most to gain…on a Fed pivot”.

Source: MarketWatch - The Fed pivot will be good for gold in 2023, says Bank of America

As we go to press, the picture remains unclear with divergent views on how long the Fed will continue to hike rates. Even so, it’s likely many investors are already preparing for the inevitable change of tack

What is an exchange traded product?

‘Exchange traded product’ is collective terminology for products traded on an exchange that invest in, or provide exposure to, underlying securities, an index, an asset (such as gold), or other financial instruments. ETPs are easily bought and sold in the same way as shares on the stock exchange.

Exchange traded funds (ETFs) are the best known category of ETPs. On a full year basis, physically-backed gold ETFs globally saw outflows of USD 3 billion in 2022, equivalent to a decline in holdings of 110 tonnes, or negative 3% year-on-year.

However, in Australia, The Perth Mint’s ETP, PMGOLD, bucked the trend, with holdings of physical gold up from 7.568 tonnes to 7.632 tonnes, or positive 0.84% year-on-year.

PMGOLD

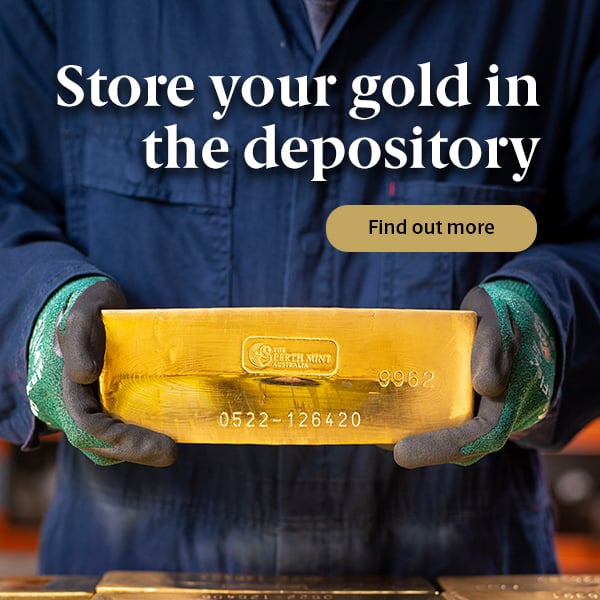

PMGOLD is designed to track the international price of gold in Australian dollars and offers investors a simple, low cost way to access the returns on the precious metal. Bought and sold on the Australian Securities Exchange (ASX), client holdings are fully underpinned by government-backed gold safeguarded in The Perth Mint’s central bank grade security vaults.

Structured as a warrant, PMGOLD is classified as an ETP. The product’s specific terms and conditions means that holders may redeem their underlying gold for cash, or choose to take physical delivery in Australia from as little as one troy ounce.

Providing Australian investors with a significant competitive edge, PMGOLD’s management fee is just 0.15%, making it the lowest cost gold ETP on the ASX.

The future of gold holdings

The popularity of ETFs and products such as PMGOLD continue to grow in Australia.

According to widely reported figures, the industry saw AUD 13.5 billion of net inflows in 2022 across all sectors. There are now 1.9 million Australians investing in ETFs, representing investor growth of 6% year-over-year. Furthermore, the value of ETFs traded on the ASX reached an all-time high of AUD 117 billion compared to AUD 95 billion the year prior, with 52 new ETFs launched on Australian exchanges in 2022.

Gold appears to be one sector with the potential for further growth. While fears of recession and central bank buying may provide support for gold going forward, a less hawkish Fed should see a weaker US dollar – which may help to drive gold prices higher in 2023.

Sources: World Gold Council, LBMA, ASX, Investopedia, Reuters.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.