Gold soars to new highs while demand remains weak

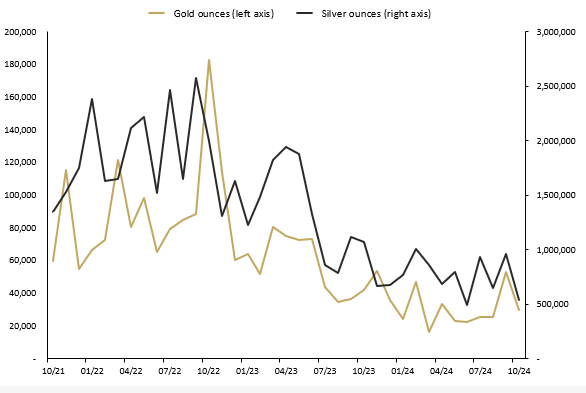

The Perth Mint sold 29,935 troy ounces (oz) of gold and 539,898 oz of silver in minted product form during October 2024.

The Perth Mint sold 29,935 troy ounces (oz) of gold and 539,898 oz of silver in minted product form during October 2024.

Opening the month around USD 2,635, the gold price traded in a narrow band at this level until the release of stronger than forecast US non-farm payroll data caused gold to drop as the market reassessed the chance of a big US rate cut in November. The price fell to a low around USD 2,610 before charging ahead, surpassing the USD 2,700 barrier and gaining almost USD 200 over several trading sessions, recording several new all-time highs along the way. In the second half of the month gold was supported by ongoing geopolitical concerns in the Middle East and the uncertainty surrounding the outcome of the US presidential election. At the end of the month gold was down from its elevated levels as positions were closed out and profits realised with the price hovering around USD 2,740 for a 4% gain in October.

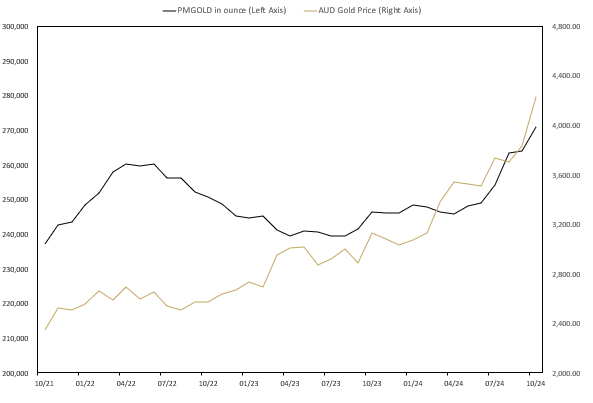

In Australian dollar terms, the gold price moved sharply higher in October boosted by the weaker AUD. The stronger USD, coupled with concerns in regional markets, drove the AUD down reversing all gains made in September. The gold price breached AUD 4,000 for first time mid-month and remained above this level, rising more than 9.5% in AUD terms for October.

Silver commenced the month trading around USD 31.10 before trending higher, supported by the rising gold prices and momentum driven trading. Silver traded at a 12-year high of close to USD 34.50 before dropping slightly by end of the month to trade around USD 33.50. This represented an 8% monthly gain and more than 41% year to date, outperforming gold.

The Australian dollar silver price in hit new records in October trading through the AUD 50 level. As with gold, the weaking AUD supported the sharp rise in price. The price dropped by end of month as profits were realised. Silver rose more than 13% for the month and is up almost 45% year to date.

The Gold Silver Ratio was above 84 at the end of month having fallen to below 79 intramonth demonstrating the volatile nature of trading in October with many factors weighing on price and sentiment.

Minted products

The Perth Mint sold 29,935 oz of gold and 539,898 oz of silver in minted product form during October.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

29,935

- 44%

18%

- 29%

Silver

539,898

- 44%

-43%

-50%

October 2024 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said challenging market conditions were persisting and the high gold price continued to impact on sales of minted products.

"However, the customer response to our Australian Lunar Series III 2025 Year of the Snake has been pleasing and more exciting releases featuring new designs will be released in coming months,” Mr Vance said.

“I’m also eagerly awaiting our annual Kangaroo bullion release which is always hugely popular."

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in October 2024

- Australian Wombat 2024 1oz Silver Bullion Coin

- Super Pit 2024 1oz Silver Individual Bullion Coin

- Super Pit 2024 1oz Silver Bullion Coins in Tube

- Super Pit 2024 1oz Gold Bullion Coin

- Super Pit 2024 5oz Gold Bullion Coin

- Welcome Nugget 2024 1oz Gold Bullion Coin

- Chinese Myths and Legends Four Guardians 2024 1oz Silver Bullion Coin

For more new product information visit the bullion web page.

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during October 2024. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

Perth Mint Gold (ASX:PMGOLD)

Perth Mint Gold is an exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD web page. PMGOLD webpage.

Total holdings in Perth Mint Gold (ASX:PMGOLD) increased during October, with holdings increasing by 7,006 oz (2.65%). This brings total holdings in PMGOLD to 270,919 ounces (8.43 tonnes) continuing the growth in the product.

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) October 2021 TO October 2024