Monthly sales report August 2022

Depository silver and physical gold sales post growth as prices retreat in August.

- The Perth Mint sold 84,976 troy ounces (oz) of gold and 1,655,334oz of silver in minted product form during August.

- The Perth Mint depository’s total gold holdings increased slightly by 0.33%; silver increased by 1.10% during the month.

- Holdings in The Perth Mint listed ETF, ASX:PMGOLD, remained largely static, up by just 0.06% for the month.

The price of both gold and silver lost ground in August.

Initially, gold continued its recovery from July’s 15-month low. Starting the month at just under USD 1,766oz, it claimed USD 1,800 as markets continued to bet that the U.S. Federal Reserve would be less aggressive with interest rate hikes given the slowing US economy. However, by mid-month, more hawkish Fed comments saw gold fail to find traction as it slipped to just above USD 1,711 at month’s end (-3.11%).

Gold in Australian dollars traded in a similar fashion with a strong downtrend commencing mid-month. For local investors, however, losses were mitigated by a weaker Australian dollar. Prices ended August at just above AUD 2,499 (-1.09%).

Silver faced an even bigger challenge. Starting the month just above USD 20.30, a massive mid-month sell-off saw it fall to just under USD 18.00 (-11.60%) by the end of August.

The gold silver ratio ended the month at 95, up three from July.

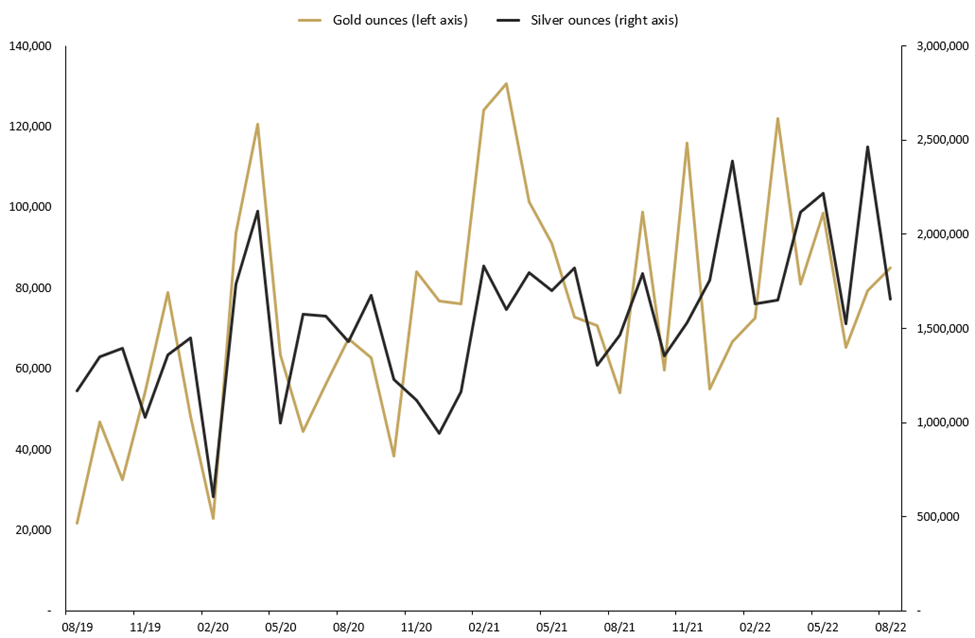

Minted products

The Perth Mint sold 84,976oz of gold and 1,655,334oz of silver in minted product form during August.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago, and against monthly average sales dating back to mid-2012.

Current month sales of gold and silver sold as coins and minted bars (troy ounces) and change (%) relative to prior periods. Troy ounces of gold and silver sold as coins and minted bars August 2019 to August 2022

Precious Metal

Current month

One month %

Three months %

12 months %

Long-term average

Gold

84,976

7%

-14%

57%

67%

Silver

1,655,334

-33%

-25%

13%

63%

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala and Lunar series. For more product information visit the bullion web page.

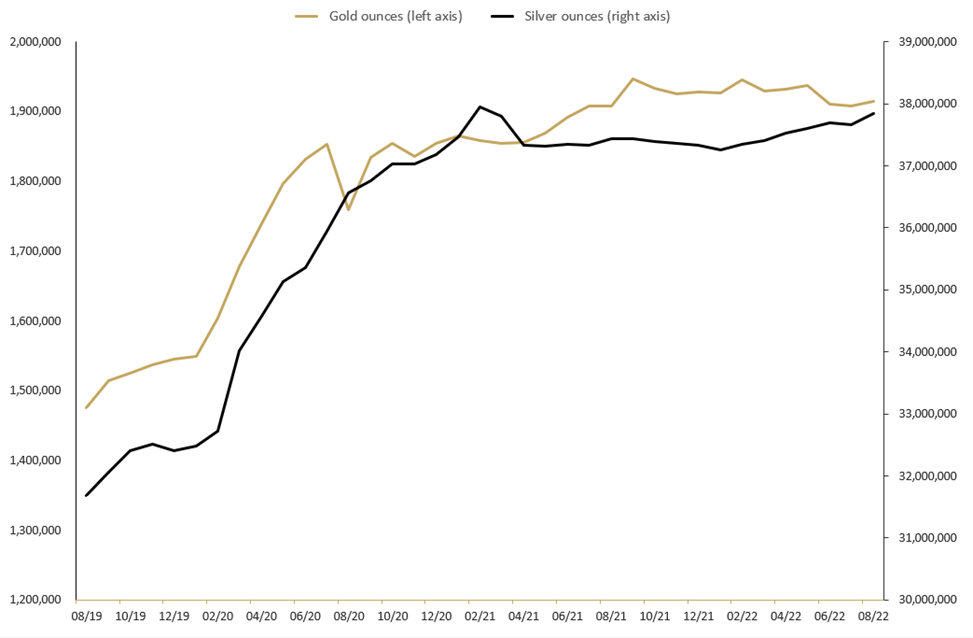

The Perth Mint Depository

Total gold holdings in The Perth Mint depository increased by 0.33%, while silver increased by 0.41% during August. Compared to 12 months ago, holdings of gold were up by 0.31% while silver holdings were up 1.10%.

Looking back to Aug 2019, holdings of gold have increased by approximately 30% and silver by 19%.

TOTAL TROY OUNCES OF GOLD AND SILVER HELD BY CLIENTS IN THE PERTH MINT DEPOSITORY August 2019 TO August 2022

The Perth Mint depository enables clients to invest in gold, silver, and platinum, with The Perth Mint storing this metal in its central bank grade vaults. Operated via a secure online portal, a Depository Online Account allows investors to buy, store and sell their metal 24/7. For further information visit the depository web page.

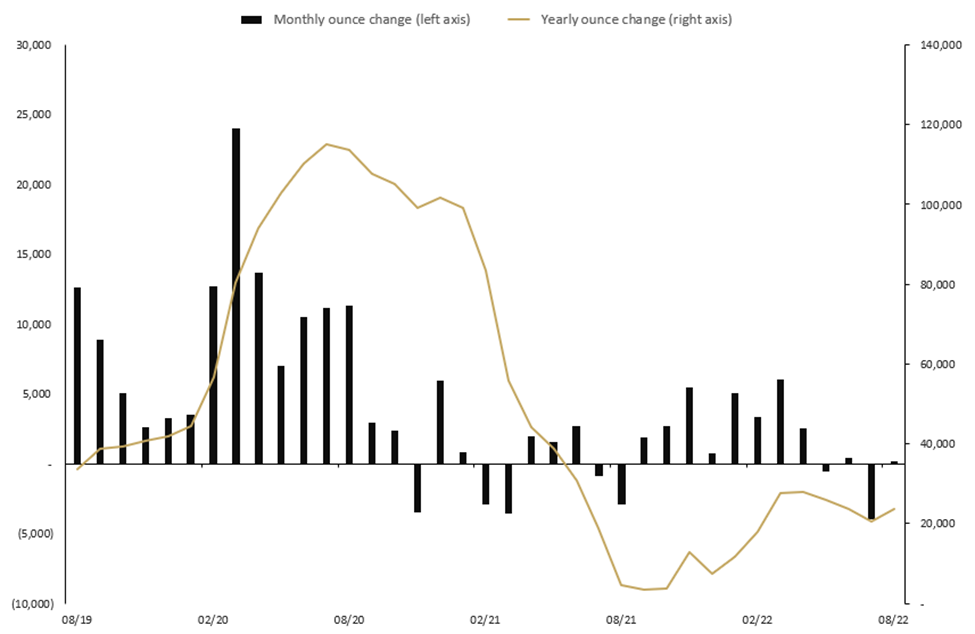

Perth Mint Gold (ASX:PMGOLD)

Total holdings in Perth Mint Gold (ASX:PMGOLD) were almost unchanged during August, with holdings up by 155oz (+0.06%). This brings total holdings in PMGOLD to 256,290oz (7.79 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) August 2019 TO August 2022

Source: The Perth Mint, ASX, World Gold Council

The total value of PMGOLD holdings was AUD 640.3 million at the end of August, with the gold price trading just above AUD 2,499oz.

To learn more about investing in PMGOLD, visit the PMGOLD page.