Softened demand for bullion continues as gold price reaches record highs

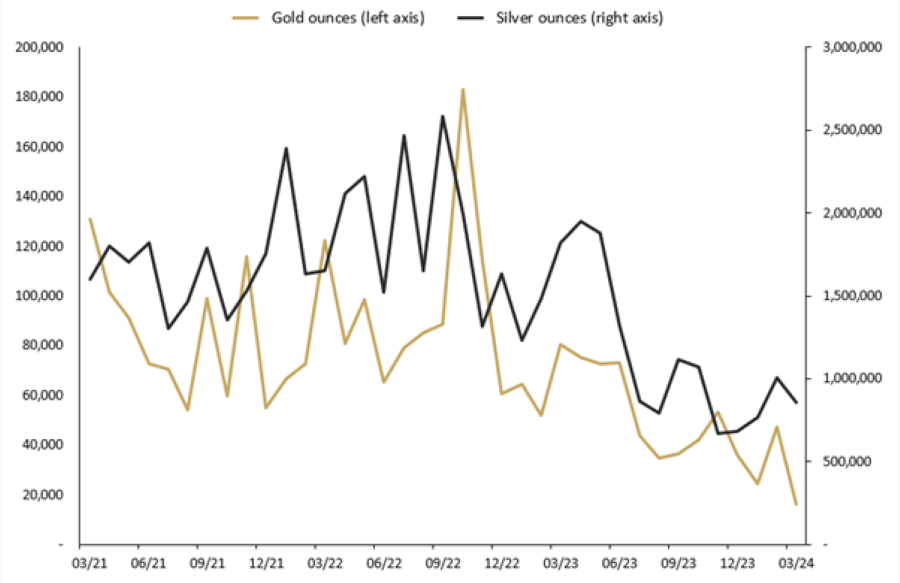

The Perth Mint sold 16,442 troy ounces (oz) of gold and 860,672 oz of silver in minted product form during March 2024.

Opening near USD 2,035 an ounce, the gold price hit a record of USD 2,150 on 7 March buoyed primarily by a weaker USD and a decline in yields. The mid-month release in the US of non-farm payroll data, which beat expectations, coupled with the broadly expected February CPI data boosted bets of an early US rate cut and kept gold at elevated levels.

Gold jumped again to another new record following the FOMC meeting which maintained its policy forecast of 75bps of rate cuts for 2024. Several additional factors are contributing to the current gold rally including an increase in open future positions, additional purchasing via ETFs, and geopolitical factors. Gold ended the month above USD 2,200 which has been a key resistance level, for a 9% gain for the month.

In Australian dollar terms, the gold price moved materially higher in March, buoyed by the increase in USD terms and additionally supported by a slight weakening of the Australian dollar.

Silver started the month trading around USD 22.50 an ounce and steadily rose higher before breaching the USD 25 mark which has been a key resistance level. The metal moved broadly in line with gold during March to end the month slightly under the USD 25 level but still up almost 8.50% for the month.

As with gold, the silver price in Australian dollar terms was markedly higher in March ending the month trading above AUD 37.50.

The Gold Silver Ratio dropped down to near 85 mid-month before rising to 90 by the end of March.

Minted products

The Perth Mint sold 16,442 oz of gold and 860,672 oz of silver in minted product form during March.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

One month %

Three months %

12 months %

Gold

16,442

-65%

-55%

-80%

Silver

860,672

-15%

26%

-53%

MARCH 2024 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products Neil Vance said the fall in demand for gold in March was aligned to the continued softening in bullion product sales globally as customers responded to the rising prices for precious metal investment products.

“We anticipated a fall in sales in March after the bump in interest in February associated with the release of our 2024 Australian Kangaroo series which featured the effigy of King Charles III for the first time,” Mr Vance said.

“Our silver minted products sales have held up more strongly but the softening in demand for silver also mirrors a global trend.

“This is typical of our industry where we, like all Mints around the world, are subject to the ebbs and flows in market demand for precious metal investment products.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for the purity and weight of its products, The Perth Mint coins include annual releases of the renowned Australian kangaroo, kookaburra, koala and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in March 2024

- Australian Kookaburra 2024 1 Kilo Silver Bullion Coin

- Australian Wedge-tailed Eagle 10th Anniversary 2024 1oz Silver Bullion Coin

Bullion coins recently ‘sold out’ at The Perth Mint

- Swan 2024 1oz Silver Bullion Coin

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during March 2024. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

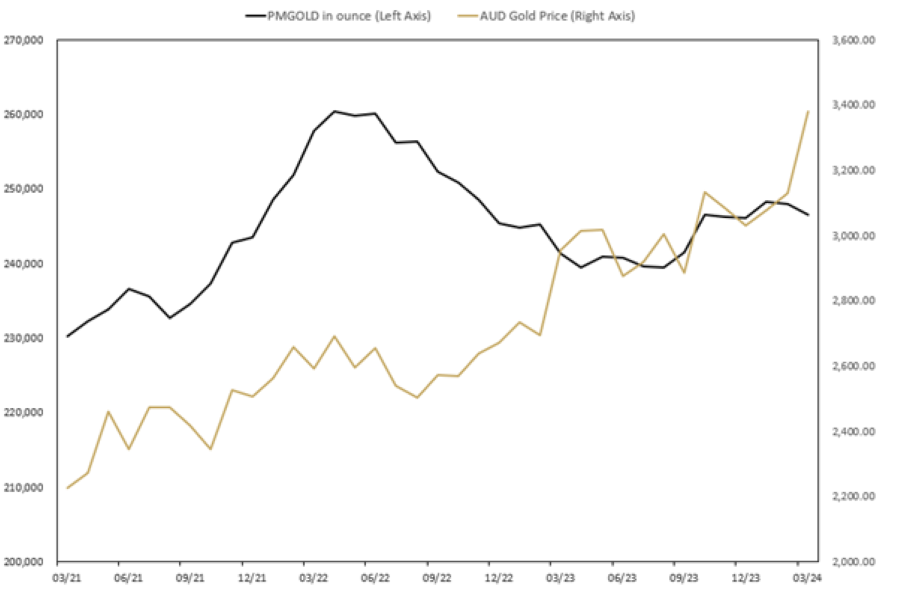

Perth Mint Gold (ASX:PMGOLD)

Perth Mint Gold is an exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD web page.

Total holdings in Perth Mint Gold (ASX:PMGOLD) decreased during March, with holdings decreasing by 1,463 oz (-0.59%). This brings total holdings in PMGOLD to 246,443 ounces (7.67 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) MARCH 2021 TO MARCH 2024.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.