Strong gold, silver prices keep lid on demand for minted products

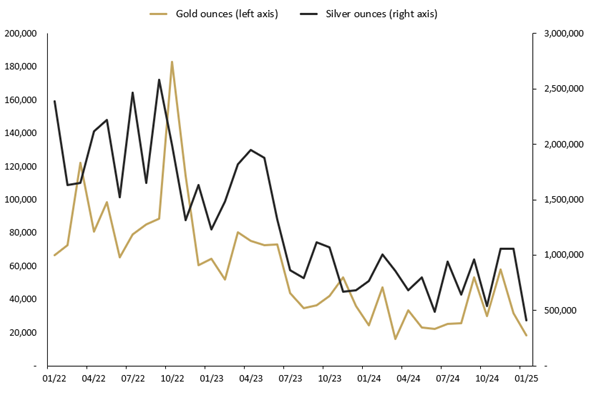

The Perth Mint sold 18,548 troy ounces (oz) of gold and 414,975 oz of silver in minted product form during January 2025.

Opening the month around USD 2,625, the gold price moved higher in January amid global concerns over the impact of US tariffs resulting in a dislocation between the COMEX gold futures price and the London spot gold price. This led to increased demand for physical metal to close out the COMEX contracts resulting in heavy bullion buying and pushing the price higher.

During the month as concerns over the possible impact of tariffs were assessed the gold price was driven higher and most of the normal factors impacting the gold price were sidelined. By the end of the month, gold was at record highs above USD 2,800, a gain of more than 6% for the month.

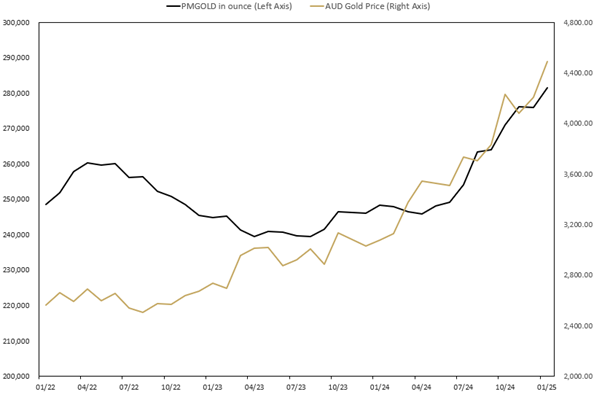

In Australian dollar terms, the gold price also moved higher in January. The ongoing strength of the US dollar and concerns around the potential impact of tariffs on Australia’s main export markets have impacted the AUD and it continued to trade at weaker levels. Gold ended the month around AUD 4,490 after hitting all-time highs for a monthly gain of 6.50%.

Similar to gold, silver was supported by the concerns over potential impact of tariffs and increased demand for physical silver. Silver rose by over 9% to end the month trading around USD 31.50.

The silver price in Australian dollar terms was also higher for January, with the minimal movement in the exchange rate resulting a materially higher silver price. At the end of the month silver was trading near AUD 51.

The Gold Silver Ratio was at 89 at the end of month with slight outperformance by silver resulting in the drop in the ratio from the previous month.

Minted products

The Perth Mint sold 18,548 oz of gold and 414,975 oz of silver in minted product form during January.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

18,548

-42%

-38%

-25%

Silver

414,975

-61%

-23%

-46%

JANUARY 2025 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said the extraordinary prices for gold and silver had continued to dampen demand for precious metals in minted product form.

“Customers are more likely to be selling to take advantage of the current high returns at this point of the cycle,” Mr Vance said.

“We continue to work hard to develop high quality and innovative numismatic and bullion products, such as our Australian Lunar Year of the Snake range, to meet the expectations of all our customers.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in January 2025

- Lunar Dragon 1oz Silver Minted Bar in Tube

- Lunar Dragon 1oz Silver Minted Bar in Pouch

- Australian Lunar Series III 2025 Year of the Snake 1oz Silver Bullion Coin with Dragon Privy

- Australian Lunar Series III 2025 Year of the Snake 1oz Gold Bullion Coin with Dragon Privy

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during January 2025. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

Perth Mint Gold (ASX:PMGOLD)

Perth Mint Gold is an exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD web page. PMGOLD webpage.

Total holdings in Perth Mint Gold (ASX:PMGOLD) increased during January, with holdings up by 5,555 oz (2.01%). This brings total holdings in PMGOLD to 281,427 ounces (8.75 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) JANUARY 2022 TO JANUARY 2025