Gold starts the year on back foot as markets fall

Executive summary

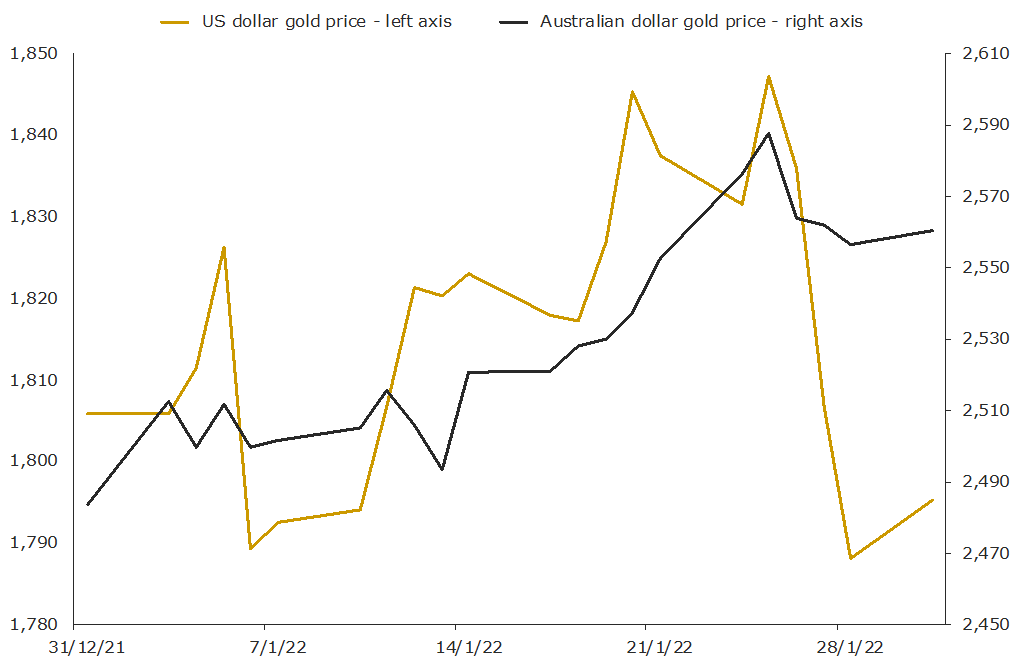

- Gold prices traded in a wide range during January, ending the month at USD 1,795 per troy ounce (oz), down 1.4%.

- Australian investors fared better, with the local gold price ending January up 2.2%, at AUD 2,561oz.

- January saw heightened volatility across a range of asset classes, with the US equity market (S&P 500) down more than 5%, while Bitcoin fell by more than 20%.

- Commodities continued to move higher, driven by oil which rose by 17% to end January trading just below USD 90 per barrel.

- Expectations of tighter monetary policy from the US Federal Reserve, continued fears over higher inflation, and rising geopolitical tension between Russia and the Ukraine, were key factors influencing markets.

Gold falls sharply at month’s end

Gold prices were strong for most of January and at one stage looked set to break higher, pushing up toward USD 1,850oz by the 25th.

This momentum was, however, unable to be maintained, with the metal falling sharply in the last week of January as markets began to price in tighter policy rates from the US Federal Reserve.

Though rate hikes were always expected in 2022, there is no doubt the market has taken on a more ‘hawkish’ tone of late. A large number of banks are now stating they expect to see up to five interest rate increases this year, while one, Bank of America, has predicted up to seven rate hikes in 2022.

Even though rate hikes aren’t necessarily bad for gold (more on this below), the speed at which markets have repriced the outlook for interest rates obviously caught gold market investors by surprise.

This repricing, which helped the US dollar rally and saw bond yields continue to rise, was the primary cause of the almost USD 60oz drop in gold that we saw in four trading days towards the end of the month, which can be seen clearly in the chart below.

Daily US and Australian dollar gold prices per troy ounce January 2022

Source: World Gold Council

Local investors were largely protected from this correction, as the Australian dollar also fell in this period, ending the month trading just above USD 0.70.

Volatility is back

While gold recorded with a small loss for the month, it fared much better than many other markets, with sharp losses seen across risk assets.

Equity markets were led to the downside by the tech heavy NASDAQ, which declined by 9% during January, one of its worst starts to the year on record.

The S&P 500, which at one point was down almost 10% intra-month, rallied in the final trading days, but still fell by more than 5%. Locally, the ASX 200 was down 7% in January.

Bond yields also rose, with the US 10-year bond ending January with a yield of 1.79%, up from 1.52% at the end of last year. Real yields rose even more sharply, with declining breakeven inflation rates contributing to the move.

This yield spike meant that fixed income assets were unable to provide the protection investors typically hope for, with the Bloomberg US Aggregate Bond Index dropping 2.2% for the month.

This led 60/40 portfolios (comprising 60% equities and 40% bonds) to fall by more than 4% in January, their worst decline since markets first crashed on COVID-19 concerns back in Q1 2020.

More exotic assets were no help either, with cryptocurrency investors reminded again that while assets like Bitcoin might be marketed as ‘digital gold’, they don’t behave anything like it.

The world’s largest crypto asset fell by more than 20% during January and has now fallen by more than 45% since its peak in late 2021.

Outlook – market bears now outnumber bulls

After a year that saw both incredibly strong performance and subdued levels of volatility in risk assets, January’s market moves will serve as a timely reminder to investors that returns in traditional asset classes may be harder to come by going forward.

Sentiment has clearly been affected, with an AAII sentiment survey in late January showing bears outnumbered bulls by 30%, a clear sign that fear has overtaken greed as the primary driver of markets.

In the short term, that could actually mean markets are set to bounce, though greater investor caution is likely to support gold going forward. The potential for geopolitical tensions to ratchet higher would also likely be a tailwind, as the precious metal typically benefits from safe haven flows.

Indeed, while gold ended up falling for the month due to the sharp sell-off in the last few trading days, it was well supported on the investment side for most of January.

This was seen through global gold ETFs, which saw inflows of approximately 40 tonnes (USD 2.3 billion) during the month, while managed money speculators also increased their net long positions.

ETF flows and managed money positioning are often correlated to the gold price itself, so this will be an indicator to watch going forward, especially as ETF investors had been reducing their gold exposure for most of 2021.

Signs of more sustained inflation, due to continued supply chain issues, higher commodity prices, or continued upside pressure on wages, could also act as a tailwind for gold this year.

One factor to watch will be shelter costs, which are the largest weight in the US CPI basket. Analysis from Morgan Stanley suggests rising shelter costs will add upside pressure to overall inflation rates into the second half of this year, though for now markets are still acting as if, on aggregate, cost of living pressures will soon ease.

The primary headwinds for gold right now appear to be continued strength in the US dollar (+0.9% for January and +6.6% in the last 12 months) and the rise in bond yields.

While both could continue to push higher, it’s possible the challenge higher rates pose to equity markets could end up supporting gold, with the precious metal and the US dollar having risen together in the past.

As a final observation, gold should be able to weather the interest rate hikes the US Federal Reserve will almost certainly deliver (most likely by March at the latest), with history suggesting the precious metal not only typically rises but outperforms other assets in periods of tighter monetary policy.

Indeed, research from the World Gold Council has found that during the past four rate hiking cycles (from the mid 1990s forward), gold has delivered an average gain of 11.34% in the six months after the US Federal Reserve first hikes rates, versus a return of just 4.17% for US stocks.

A similar move in this cycle would see gold push back toward USD 2,000oz in the second half of 2022, provided it doesn’t correct any further in the interim.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.