Gold rebounds as markets continue to charge higher

Precious metal prices rallied in April, with gold and silver up 5% and 8% respectively. Lower yields and a fall in the US dollar contributed to the moves, with the sector at least temporarily halting a multi-month corrective period that dates back to August 2020, when gold was trading at all-time highs. Despite the bounce, there were some headwinds for precious metals, the most notable of which was the continued rally in risk assets, from equities through to cryptocurrencies.

Summary of market moves:

- Gold and silver prices rallied strongly in April, with the two precious metals up 5% (gold) and 8% (silver) in US dollar terms.

- The rally was not unexpected, given technical and market sentiment readings had plunged during Q1 of this year, when precious metals fell by close to 10%.

- A decline in real bond yields and a 2% fall in the US dollar contributed to the April rise in precious metals, which has so far continued in the first few trading days of May.

- Despite the price increases, precious metals continue to be held back by surging equity markets and continued euphoria in cryptocurrencies

- Gold demand figures released by the World Gold Council (WGC) highlighted surging gold bar, coin and jewellery demand in Q1 2021, while ETFs suffered some of their largest outflows on record. Central banks remained net buyers of gold, led by Hungary, which acquired over 60 tonnes during the quarter.

Full report - April 2021

Gold and silver prices rallied strongly in April 2021, with the two precious metals rising by 5% and 8% respectively in US dollar terms, ending the month at USD 1,767.65 and USD 25.88 per troy ounce.

Gains for Australian investors were more subdued. Gold finished 2% higher and silver was up 5% for the month owing to a rally in the Australian dollar, which finished April trading just below USD 0.78.

Given gold and silver prices fell by 11% and 9% during Q1 2021, the rally seen in precious metals during April was not unexpected. The fact that technical indicators were as oversold as they were by late March, and that sentiment readings were at or near some of their lowest points seen in the last two decades, it was most likely that the next move in precious metals would be to the upside. This is exactly what has transpired in the past few weeks.

Developments in financial markets helped drive the bounce, with real yields declining across the maturity spectrum during April. As an example, the real yield on a US 10-year Treasury dropped from -0.63% to -0.76%.

Commodity prices also continued to increase during April, with the Bloomberg Commodity Index up more than 8%. Meanwhile, breakeven inflation rates continued to edge higher across the month, with these factors supporting higher bullion prices.

The US dollar also weakened against a basket of currencies, with the US Dollar Index (DXY) falling by more than 2% to end the month sitting at 91.28.

Despite the bounce, precious metals were held back in April to a degree by soaring prices for risk assets, from equities to cryptocurrencies, as we highlight in more detail below.

Risk on for equities

Since the lows seen in March 2020, global equity markets have staged one of their most impressive rallies on record, with the S&P 500, for example, rising by more than 80% in just over a year. The market rose by more than 5% in April 2021 alone.

The staggering rise has been met with almost unprecedented levels of buying, with data from Bank of America suggesting more than USD 600 billion has flowed into global equity markets in the last five months. That figure surpasses inflows seen in the prior 12 years combined.

Investors are not only happy to deploy cash, but also leverage their way into equity positions. Year on year increases in margin debt are currently close to 70%, representing a speed of increase exceeded or matched only twice in the past 25 years - just prior to the NASDAQ crash and the Global Financial Crisis.

While markets may not repeat, they do tend to rhyme. As such, though these developments are great in the short-term for equity market bulls (all the while helping hold back gold demand), they do portend a serious day of reckoning for risk assets as a whole.

If history is any guide, when that day of reckoning arrives, it would not surprise to see precious metal demand, and prices, rise accordingly.

Bitcoin pulls back - crypto craze continues

Crypto markets continued to dominate market attention in April, with US crypto exchange Coinbase listing on the NASDAQ. It closed as high as USD 342 per share on 16 April, though eased below USD 300 per share by the end of the month. At a roughly USD 80 billion market capitalisation, it is already larger than many banks and financial services companies in the United States, a clear illustration of how enthusiastic investors are to own assets that are leveraged to soaring crypto markets.

Bitcoin suffered one of its first monthly pullbacks in April, falling by almost 10% to end the month at USD 53,260 (price data from CoinDesk). Intra-month, it continued the spectacular volatility that investors either love or hate, at one-point trading as high as USD 63,346 per Bitcoin (the 16 April, which was the same day stock in Coinbase peaked), before plunging almost 20% in a matter of days, hitting USD 48,542 at its low.

Other high-profile cryptocurrencies like Ethereum and even Doge Coin, which was originally created as a joke, fared better than Bitcoin in April, rising by 50% and 468% respectively.

It is no surprise that investors are tempted to put some capital to work in frontier markets like this, given the fast money being made, and lost.

By contrast, gold, and precious metals more generally, are far more staid investments, which is exactly why they are better suited to long-term wealth preservation, as we highlighted in detail in our recently published Gold, Bitcoin and the Elon report.

‘Hungary’ for gold

Data from the WGC looking at Q1 2021 gold demand highlighted some interesting trends that illustrate the set up for the precious metal right now. Key insights include:

- A 52% year on year increase in gold jewellery demand, driven by a more than 200% increase in China. To contextualise, Q1 2020 was one of the worst quarters on record for gold jewellery demand, as it was of course during this period that COVID-19 and its associated lockdowns were wreaking havoc across much of Asia.

- A 36% year on year increase in physical bar and coin demand, with almost 340 tonnes of gold bought in this format in Q1. The number was also 37% above the five-year quarterly average for bar and coin demand, with China and India again key contributors to this increase. Western markets also saw strong demand, evidenced by minted product sales from The Perth Mint which we highlighted in our end March product update, with Q1 sales hitting all-time highs for gold.

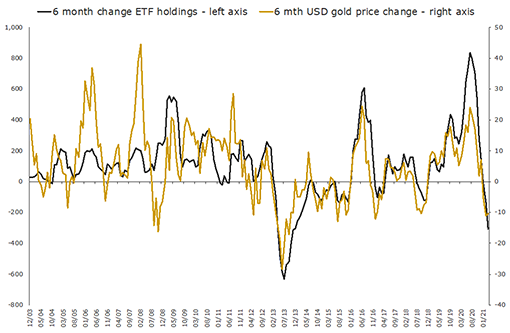

- Huge outflows from gold ETFs, with almost 180 tonnes of gold sold from these products in Q1 2021, on top of 130 tonnes of outflows seen in Q4 2020. This represents the second fastest pace of ETF outflows on record, exceeded only in 2013 when the gold price suffered a major correction. The chart below, which highlights rolling six month changes in the US dollar gold price and total gold ETF holdings, illustrates clearly just how important this segment of the market is.

Source: The Perth Mint, World Gold Council

Developments in the central bank space have also been noteworthy, with total net purchases in Q1 2021 of 95.5 tonnes. While this represents a more modest pace of acquisition that has been in place since the second half of 2020, it would still see central banks accumulate close to 400 tonnes for the year if this rate of purchases was continued.

Hungary was the main contributor to demand in Q1, purchasing 63 tonnes in March, with its central bank noting that: “The appearance of global spikes in government debts or inflation concerns further increase the importance of gold in national strategy as a safe-haven asset and as a store of value.“

So much for central banks not liking gold.

Outlook for gold – bull market back on?

While precious metal bulls should be encouraged by the bounce in prices seen in April, which has so far continued in the first few trading days of May, the market remains in a trading range, with gold likely needing to decisively break above USD 1,800 per troy ounce to tempt more investors back into the space.

For prices to rise further, ETF investors would need to turn net buyers, and/or speculators in futures markets will need to add to their long positions.

There are multiple catalysts that could see this happen should they eventuate, from a falling US dollar, to declining real yields, or a long-overdue pullback in equities and broader crypto currency markets.

On the consumer side, while it has been impressive to see the uptick in demand in 2021, there are no guarantees this will continue across the entirety of the year. Indeed, if anything, demand for jewellery in particular is likely to slow, driven largely by an expected slump in India, which, distressingly, continues to be ravaged by COVID-19.

With more than 300,000 cases of the virus diagnosed every day, the latest news suggests gold is already selling at a small discount in India, which may continue for some time, and feed into subdued overall market sentiment toward the precious metal.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.