Global events keep gold price high, demand low

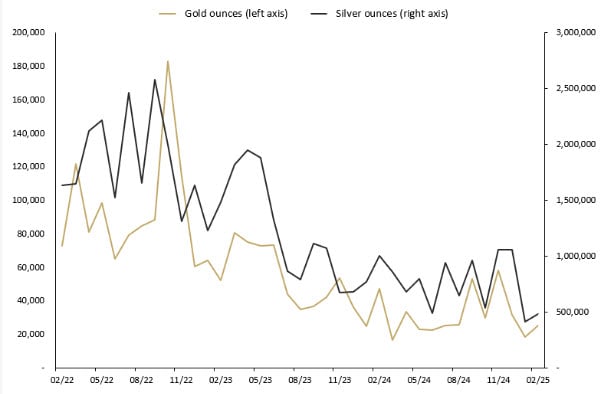

The Perth Mint sold 25,103 troy ounces (oz) of gold and 482,451 oz of silver in minted product form during February 2025.

Opening the month around USD 2,800/oz, the gold price moved higher supported by global concerns over the impact of US tariffs. This caused a dislocation between the COMEX gold futures price and the London spot gold price, resulting in increased demand for physical metal to close out the COMEX contracts, pushing the price higher.

The pause in the imposition of tariffs announced in early February did nothing to dispel the economic uncertainty as gold hit new record highs above USD 2,950. However, by the end of February, gold had corrected due to increased selling as traders closed out positions, and was trading around USD 2,830 for a modest monthly gain.

In Australian dollar terms, the gold price moved slightly higher in February mirroring the gain in USD terms. The Reserve Bank of Australia reduced interest rates to 4.1% but this was widely expected and already priced into the market. Gold ended February around AUD 4,600, while the currency was flat for the month against the US dollar.

Similar to gold, demand for silver rose amid concerns over the potential impact of tariffs. Silver briefly traded over USD 33/oz before correcting sharply to return a loss for the month trading around USD 31.15.

The silver price in Australian dollar terms was lower for February with the minimal movement in the exchange rate resulting a lower silver price. At the end of the month silver was trading near AUD 50.15 down about 1.5%.

The Gold Silver Ratio was near 92 at the end of month with the outperformance of gold resulting in an increase in the ratio from prior month.

Minted products

The Perth Mint sold 25,103 oz of gold and 482,451 oz of silver in minted product form during February.

The table below highlights how these numbers compare to sales one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

25,103

35%

-57%

-47%

Silver

482,451

16%

-54%

-52%

FEBRUARY 2025 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products Neil Vance said the high gold price continued to result in soft demand for minted products but he was pleased with the response to key February releases, including the Australian Kookaburra 2025 1 Kilo Silver Bullion Coin, and gold and silver bars in the Lunar Year of the Snake collection.

“It is heartening to see the increase in sales on January levels given precious metals prices remain at record highs,” Mr Vance said.

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in February 2025

- Lunar Snake 1oz Silver Minted Bar in Pouch

- Lunar Snake 1oz Silver Minted Bar in Tube

- Lunar Snake 1oz Gold Minted Bar

- Chinese Myths and Legends Four Guardians 2025 1oz Gold Bullion Coin

- Australian Kookaburra 2025 1 Kilo Silver Bullion Coin

- Australian Wedge-tailed Eagle 2025 1oz Silver Bullion Coin

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during February 2025. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

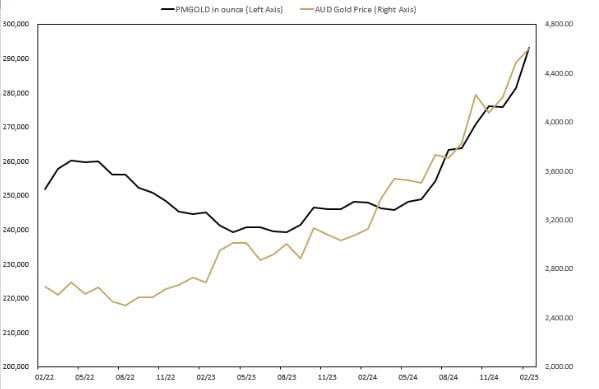

Perth Mint Gold (ASX:PMGOLD)

Perth Mint Gold is an exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD webpage.

Total holdings in Perth Mint Gold (ASX:PMGOLD) increased during February, with holdings up by 11,733oz (4.17%). This brings total holdings in PMGOLD to 293,161 ounces (9.12 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) FEBRUARY 2022 TO FEBRUARY 2025