Demand softens in December as gold price ends year on a high

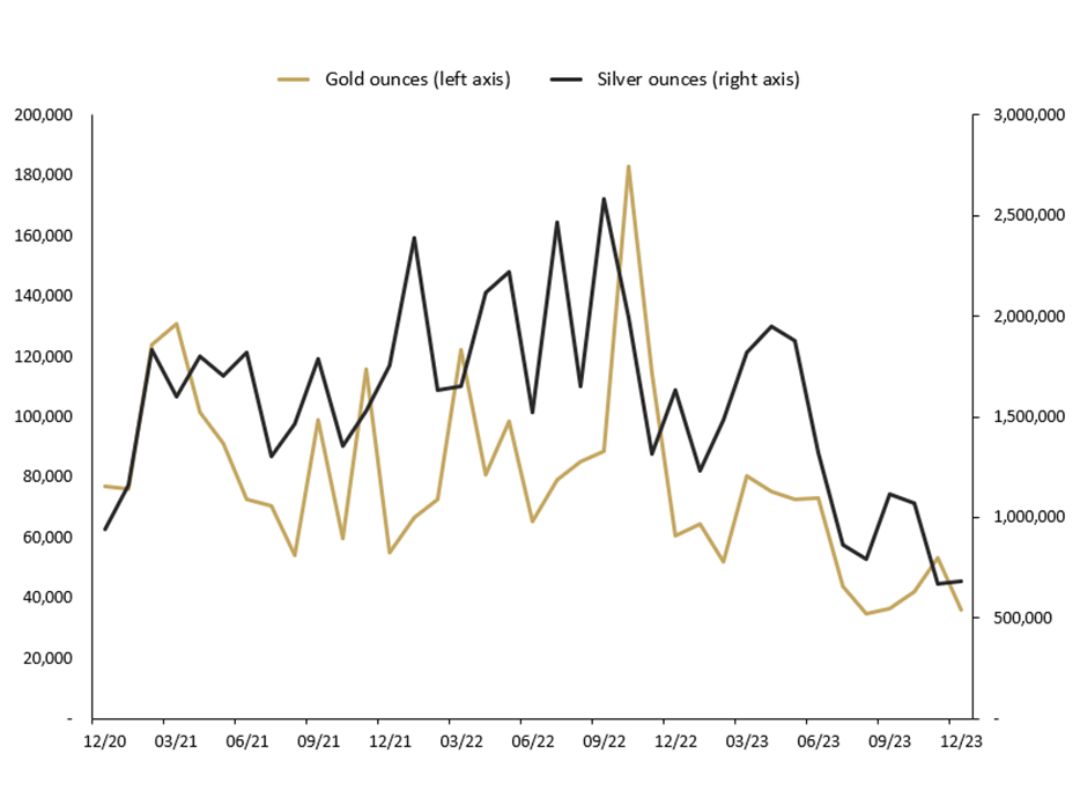

The Perth Mint sold 36,297 troy ounces (oz) of gold and 681,490 oz of silver in minted product form during December 2023.

Gold hit a record high early in the month trading at over USD 2,135. The rally was turbocharged by comments from Federal Reserve chair Jerome Powell that were interpreted as setting the stage for a pivot toward rate cuts, prompting a plunge in the US dollar and Treasury yields.

The release of November’s non-farm payroll data showing better-than-expected numbers pumped the US dollar and Treasury yields back up, resulting in a drop in the gold price which slid to near USD 1,980 over the next few trading sessions.

Post the FOMC meeting gold spiked again as the US Federal Reserve held interest rates steady and signalled that its policy tightening of the last two years was at an end. Gold continued to hold its elevated levels for the remainder of December, trading near USD 2,070 at month’s end.

The gold price in Australian dollar terms moved lower during the month after hitting a record high in October. The Australian dollar strengthened by more than 3% over the month, while the RBA left its key interest rate on hold at 4.35%.

Silver tracked lower in the period dropping below USD 23 mid-month before recouping some losses to finish December trading around USD 24. The silver price ended almost 5% lower for the month and was down slightly for the year.

The silver price in Australian dollar terms was materially lower in December, down more than 7.5% for the month. A strengthening Australian dollar added to the drop experienced in US dollar terms. On a 12-month basis silver recorded a minor decrease.

During December, the Gold Silver Ratio increased and ended the month on 86.60.

Minted products

The Perth Mint sold 36,297 oz of gold and 681,490 oz of silver in minted product form during December.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

One month %

Three months %

12 months %

Gold

36,297

-32%

-1%

-40%

Silver

681,490

1%

-39%

-58%

DECEMBER 2023 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said monthly sales were affected by two key factors. “As well as a noticeably slowdown in demand for gold bullion products in the USA, our Coining Division closed for the year on 23 December, with a consequent reduction in ounces shipped.”

“With several key releases scheduled in coming months, including January’s launch of the Australian Kookaburra 2024 Silver Bullion Coin Series, we’re hopeful of a strong start to the new year,” he added.

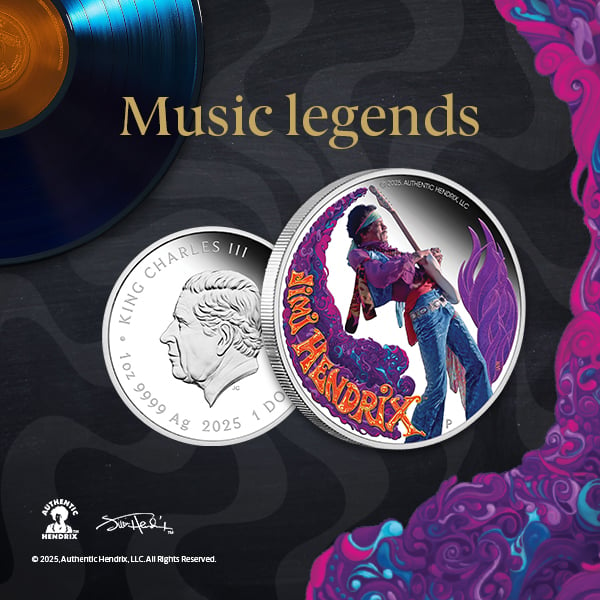

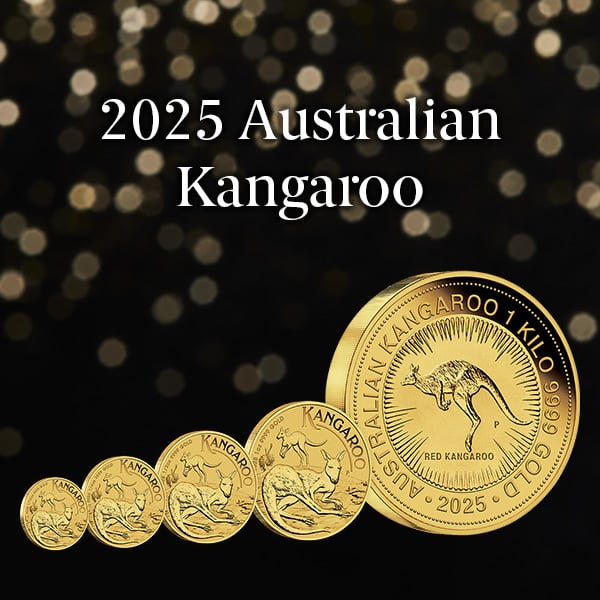

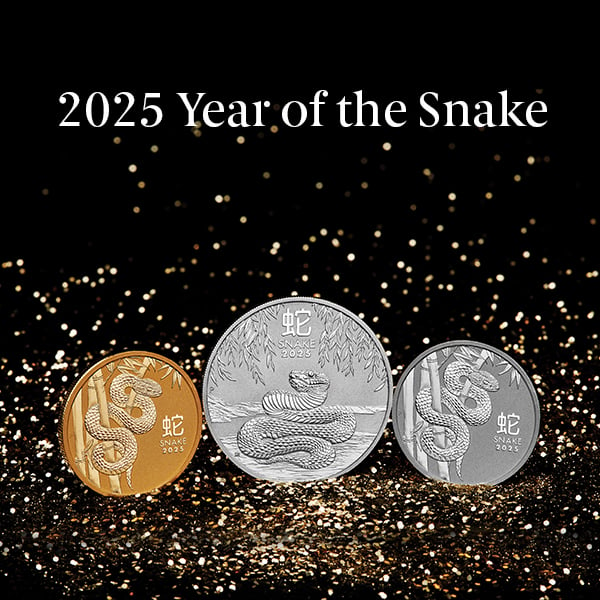

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala and Lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during December 2023. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.