Buying frenzy fuels record sales of physical gold

Summary

- Perth Mint minted product sales for both gold and silver soared during February, with more than 124,000 troy ounces of gold, and more than 1.8 million troy ounces of silver sold during the month. Relative to February 2020, sales increased by more than 400% for gold and 200% for silver, as investors took advantage of lower precious metal prices.

- Perth Mint Depository holdings of gold and silver were flat during February, with total holdings for both metals 16% higher than they were one year ago.

- Perth Mint gold ETF holdings declined by just over 1% in February, with outflows from Perth Mint Gold (ASX:PMGOLD) bringing total holdings back below 7.30 tonnes.

Market review

Precious metal prices pulled back sharply in February, led by gold, which fell by more than 6% in USD terms. A spike in bond yields, soaring prices for cryptocurrencies and a continued rise in risk assets all contributed to the sell-off, though there are some signs the correction in metals prices may be nearing its end.

Manager, Listed Products and Investment Research, Jordan Eliseo says, “The pullback in prices has led to a spike in demand for Perth Mint minted products, with gold and silver sales rising noticeably over the last month, whilst investor holdings in The Perth Mint Depository were broadly flat across the month.”

Minted Products

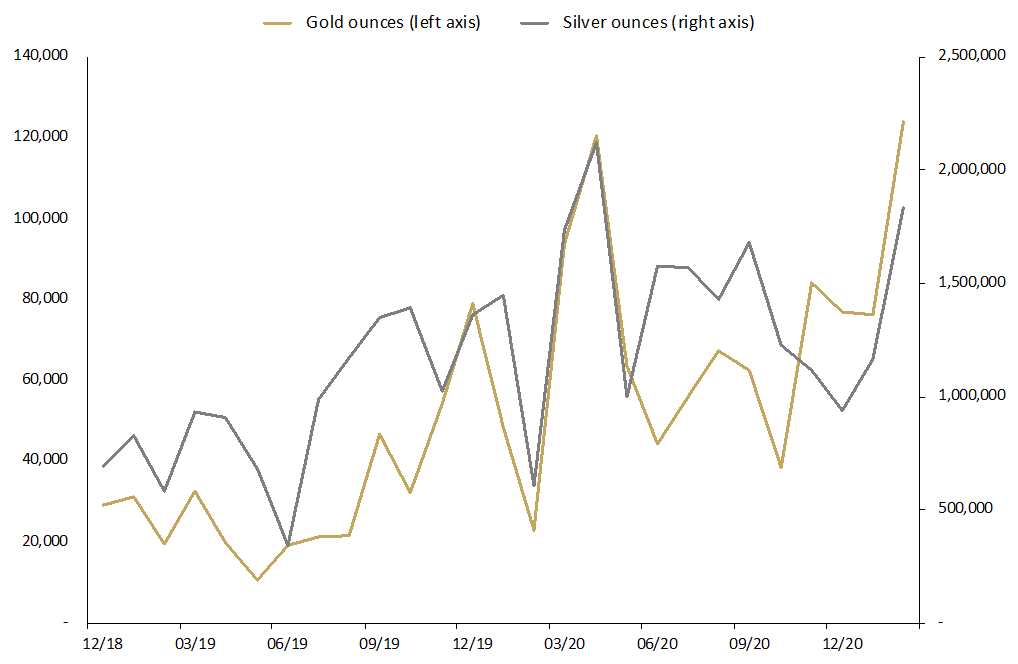

A large spike in demand for Perth Mint coins and minted bars pushed sales of physical gold to a new monthly record in February 2021. The Mint shipped 124,104 troy ounces of gold product, up 63% on the previous month and an enormous 441% on February 2020.

Sales of silver bullion coins also jumped sharply to 1,830,707 troy ounces, up more than 57% on the previous month and 202% ahead of February 2020.

Troy ounces of gold and silver sold as coins and minted bars

December 2018 to February 2021

General Manager Minted Products, Neil Vance, attributed the success to a buying frenzy in the US. “To meet demand we streamlined manufacturing to focus on products that are hot in the US right now, including our Kangaroo Minted Gold Bars made in 1oz and 10oz formats,” he said. “It was also a strong month for our signature Australian Kangaroo 1oz Gold Coin and the latest Dragon 1oz Gold Rectangle Coin which sold through its lucky 8,888 mintage in record time.”

Similar efficiencies were achieved in the production of physical silver coins, he said, which saw more Australian Kangaroo 1oz Silver Coins out the door.

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala and Lunar series.

The Perth Mint Depository

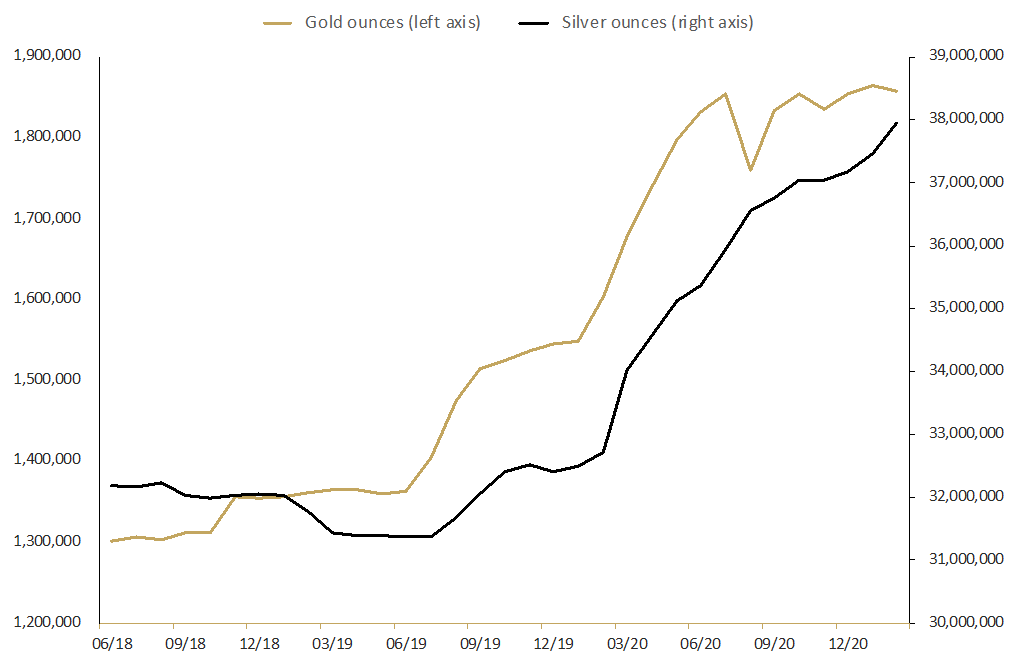

Holdings of both gold and silver in The Perth Mint Depository were broadly flat in February 2021, ending the month at 1.86 million troy ounces (gold) and 37.9 million troy ounces (silver).

The value of precious metal holdings stored by The Perth Mint Depository fell by 5% (USD terms) and 8% (AUD) terms, driven by falls in precious metal prices.

Over the last twelve months, total holdings for both gold and silver have risen by 16%, with the value of these holdings increasing by 35% (USD terms) and 13% (AUD terms), as investors continue to add precious metal allocations to their portfolios.

Total troy ounces of gold and silver held by clients in The Perth Mint Depository December 2018 to February 2021

The Perth Mint Depository enables clients to invest in gold, silver and platinum, with The Perth Mint storing this metal in its central bank grade vaults. A Depository Account is a premium brokerage style service that enables investors to contact our in-house traders by telephone or email when seeking live spot price quotes for buying or selling. Operated via a secure online portal, a Depository Online Account allows investors to buy, store and sell their metal 24/7.

Perth Mint Gold (ASX: PMGOLD)

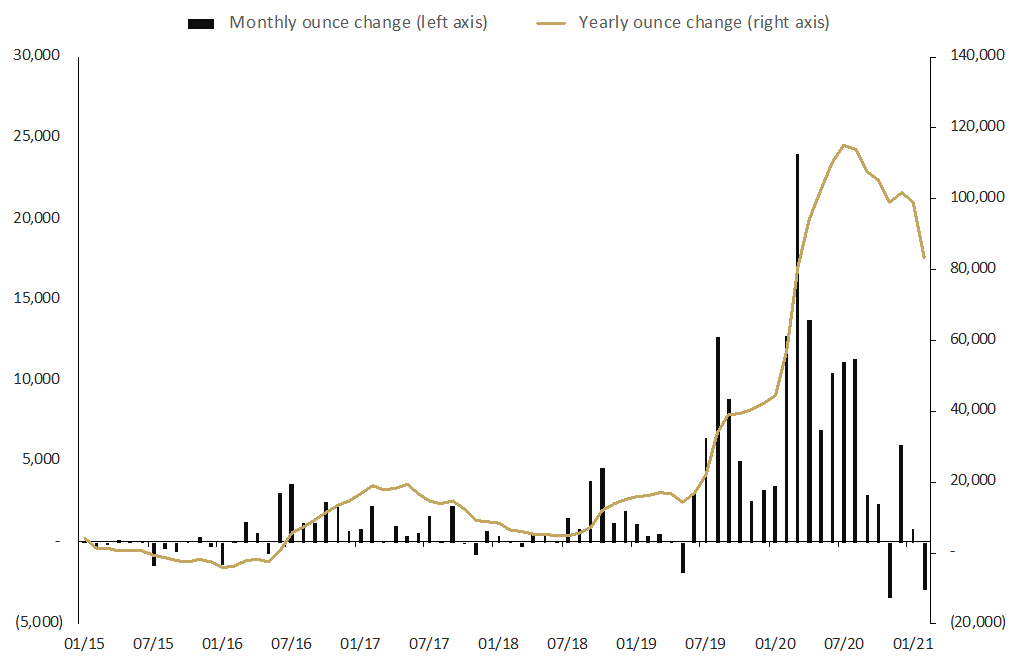

Holdings of Perth Mint Gold (ASX: PMGOLD) fell during February 2021, declining by almost 3,000 troy ounces for the month. The outflows saw total holdings in PMGOLD drop to 233,850 troy ounces, or just below 7.30 tonnes.

Monthly flows for PMGOLD and the yearly change in total troy ounces can be seen in the chart below, with holdings rising by more than 80,000 ounces (+55%) in the last twelve months.

Monthly change in troy ounces held by clients in Perth Mint Gold (ASX:PMGOLD)December 2018 to February 2021

The value of PMGOLD holdings also declined meaningfully in February, ending the month just above AUD 520 million. The fall was primarily driven by the circa 9% decline in the AUD gold price, which fell below 2,250 per troy ounce by the end of February.

Despite the decline seen in February, the value of gold holdings backing PMGOLD has risen by 40% in the last twelve months.