Bargain hunters scoop up bullion as gold and silver sales rise

Summary

- The Perth Mint sold 98,753 troy ounces of gold and 1,789,926 troy ounces of silver in minted product form during September.

- The Perth Mint’s ASX listed ETF, ASX:PMGOLD, saw holdings rise by just under 2,000 troy ounces for the month.

- The Perth Mint Depository holdings of gold rose by 2% during September, whilst holdings of silver were flat.

Manager, Listed Products and Investment Research, Jordan Eliseo said: “Precious metal prices fell sharply during September, with gold and silver falling by 4% and 10.5% respectively in USD terms. A stronger US dollar, a rise in bond yields, and an increased likelihood of a taper from the US Federal Reserve, all contributed to the sell-off, with sentiment towards the sector also being hit."

Minted Products

The Perth Mint saw a large increase in sales last month, selling 98,753 troy ounces of gold and 1,789,926 troy ounces of silver in minted product form.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago, and against monthly average sales dating back to mid 2012.

Current month sales of gold and silver sold as coins and minted bars Change relative to prior periods

Precious metal

August sales (troy ounces)

1 month

3 month

1 year

Long-term average

Gold

98,753

83%

35%

58%

107%

Silver

1,789,926

22%

-2%

7%

91%

Gold in particular saw a notable increase in demand, with sales for both precious metals remaining comfortably above long-term averages, demonstrating the continued support for precious metal investment in the market today.

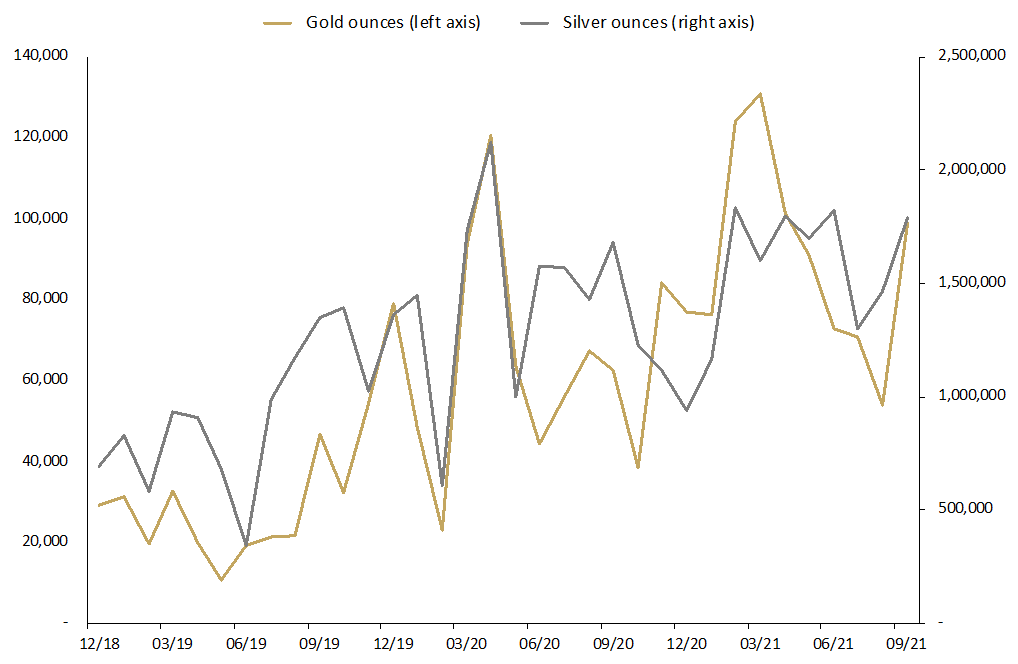

Troy ounces of gold and silver sold as coins and minted bars December 2018 to September 2021

According to General Manager Minted Products, Neil Vance, higher demand for Australian bullion coins reflected the price dips in both gold and silver during September. However, sales of Perth Mint product were given a secondary boost by the release of a new series celebrating the 2022 Year of the Tiger. “The launch of the Australian Lunar annual coin series every September is eagerly anticipated by the market, and thanks to a stockpile of these new coins we were well positioned to satisfy initial demand,” he explained.

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala and Lunar series.

The Perth Mint Depository

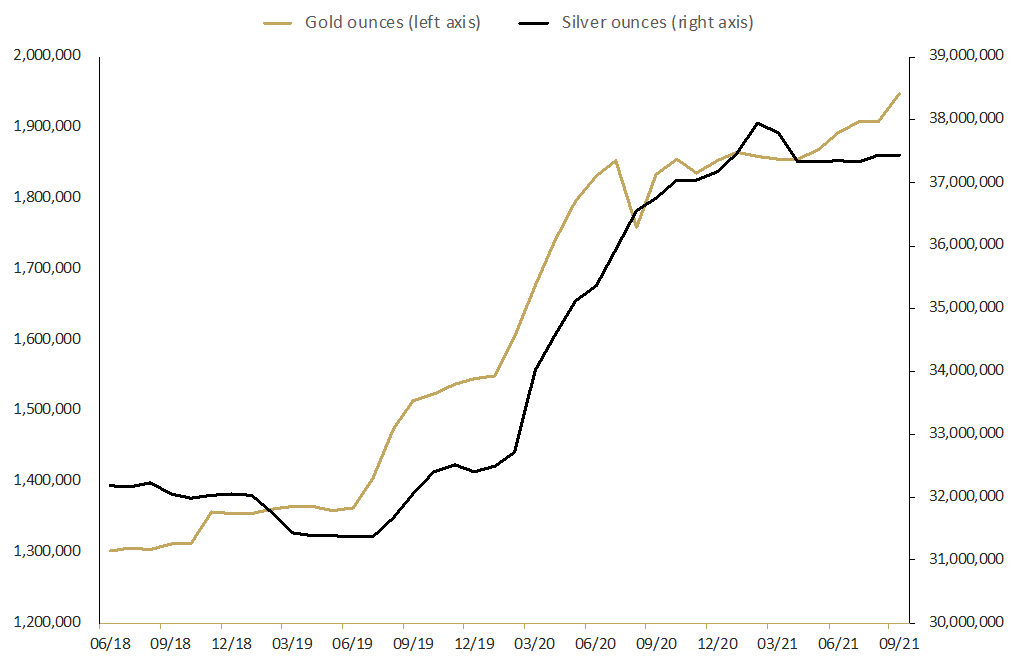

Total gold holdings in The Perth Mint Depository rose by 2% during September, while holdings of silver were static. Over the 12 months to end September, total holdings of gold and silver have increased by 6% and 2% respectively, with the total value of these holdings sitting just below AUD 6 billion.

Total troy ounces of gold and silver held by clients in The Perth Mint Depository June 2018 to September 2021

The Perth Mint Depository enables clients to invest in gold, silver and platinum, with The Perth Mint storing this metal in its central bank grade vaults. Operated via a secure online portal, a Depository Online Account allows investors to buy, store and sell their metal 24/7.

Perth Mint Gold (ASX:PMGOLD)

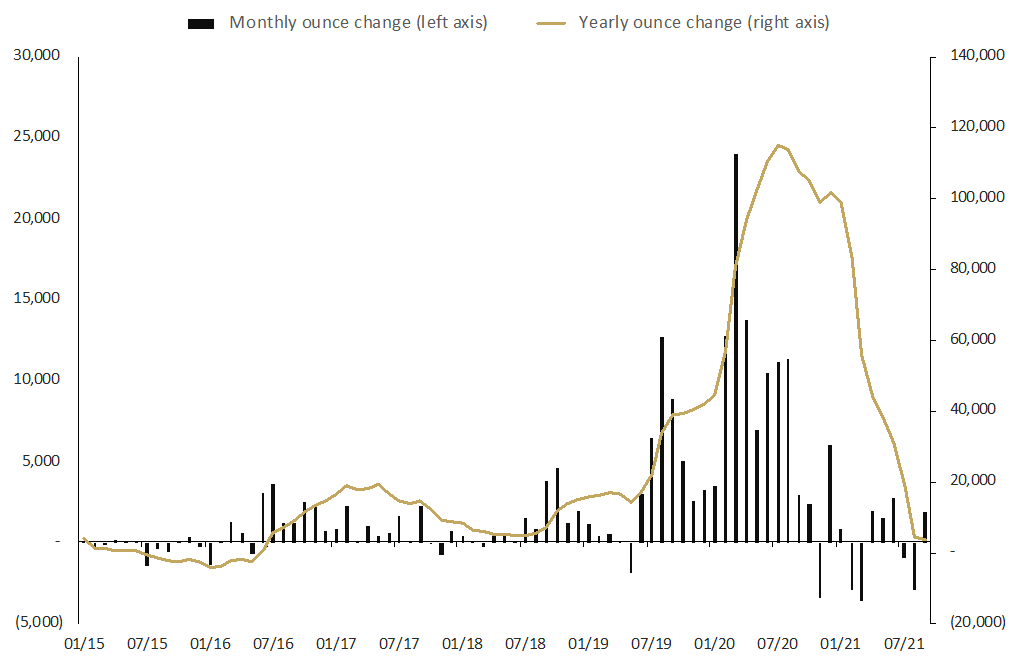

Total holdings in Perth Mint Gold (ASX:PMGOLD) rose by almost 2,000 troy ounces in August, with investors taking advantage of lower gold prices to add to their positions. The increase brings total holdings in the product to 234,548.9 troy ounces (7.30 tonnes) of gold.

Monthly change in troy ounces held by clients in Perth Mint Gold (ASX:PMGOLD) January 2015 to September 2021

Source: The Perth Mint, ASX, World Gold Council

With gold prices falling by just over 2% in AUD terms during September, the total value of PMGOLD fell to AUD 567 million, despite the increase in total holdings.

To learn more about investing in PMGOLD, download our PMGOLD Factsheet.