Australian kookaburra coins drive silver bullion sales higher in January

The Perth Mint sold 24,651 troy ounces (oz) of gold and 769,326 oz of silver in minted product form during January 2024.

Opening near USD 2,075, the gold price in US dollar terms peaked at the beginning of January on expectations of an imminent rate cut. However, the mid-month release of stronger than expected US retail sales data for December showed that the economy was resilient and that aggressive market pricing for rate cuts starting in March needed to be tempered. Gold weakened on a stronger US dollar and rising yields. Further releases from US Federal Reserve officials reinforced the message that it was “premature” to think interest-rate cuts were around the corner. At the FOMC meeting in late January the Fed funds rate was held steady as expected, with Chair Powell also pushing back on the prospect of a March rate cut, stating more evidence was required to be sure inflation was moving sustainably to target. Gold ended the month down less than 2%.

In Australian dollar terms, the gold price moved higher in January, impacted by the weakening of the Australian dollar. Nervousness in financial markets amid tensions escalating in the Middle East and ongoing concerns over the outlook for the Chinese economy, pushed the Australian dollar lower by more than 3.5% during the month.

Like gold, the silver price peaked at the beginning of the month, subsequently moving in a narrow range with little guidance from the market to support any upside. With concerns about the health of the Chinese economy, silver ended the month trading around USD 23.

The silver price in Australian dollar terms was relatively flat. Silver’s drop in US dollar terms was offset by the weakening Australian dollar, resulting in only a minor move for January.

The Gold Silver Ratio spiked above 91.5 (its highest level in 12 months) before dropping back to 89 by the end of January.

Minted products

The Perth Mint sold 24,651 oz of gold and 769,326 oz of silver in minted product form during January.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

One month %

Three months %

12 months %

Gold

24,651

-32%

-42%

-62%

Silver

769,326

13%

-28%

-38%

JANUARY 2024 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said the launch of the 2024 Australian kookaburra drove sales of silver bullion coins higher in January. “The market was quick to take up the 1oz denomination with 250,000 pieces sold within two weeks of release,” he said. “Demand for physical gold continued to ease off in our key markets as customers await the February release of our 2024 Australian Kangaroo series featuring the effigy of the new monarch King Charles III,” he added.

The Perth Mint’s General Manager Minted Products, Neil Vance, said the launch of the 2024 Australian kookaburra drove sales of silver bullion coins higher in January. “The market was quick to take up the 1oz denomination with 250,000 pieces sold within two weeks of release,” he said. “Demand for physical gold continued to ease off in our key markets as customers await the February release of our 2024 Australian Kangaroo series featuring the effigy of the new monarch King Charles III,” he added.

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in January 2024

- Australian Lunar 2024 Year of the Dragon 1 Kilo, 5oz Silver Bullion Coins

- Australian Lunar 2024 Year of the Dragon 1/20oz Gold Bullion Coin

- Australian Kookaburra 2024 1oz Silver Bullion Coin

For more new product information visit the bullion web page.

Bullion coins recently ‘sold out’ at The Perth Mint

- Australian Lunar Series 2024 Year of the Dragon 1oz Silver Bullion Coin

- Australian Lunar Series 2024 Year of the Dragon 1oz Gold Bullion Coin

- Australian Lunar Series 2024 Year of the Dragon 1oz Platinum Bullion Coin

- Wombat 2023 1oz Silver Bullion Coin

- Quokka 2023 1oz Silver Bullion Coin

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during January 2024. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

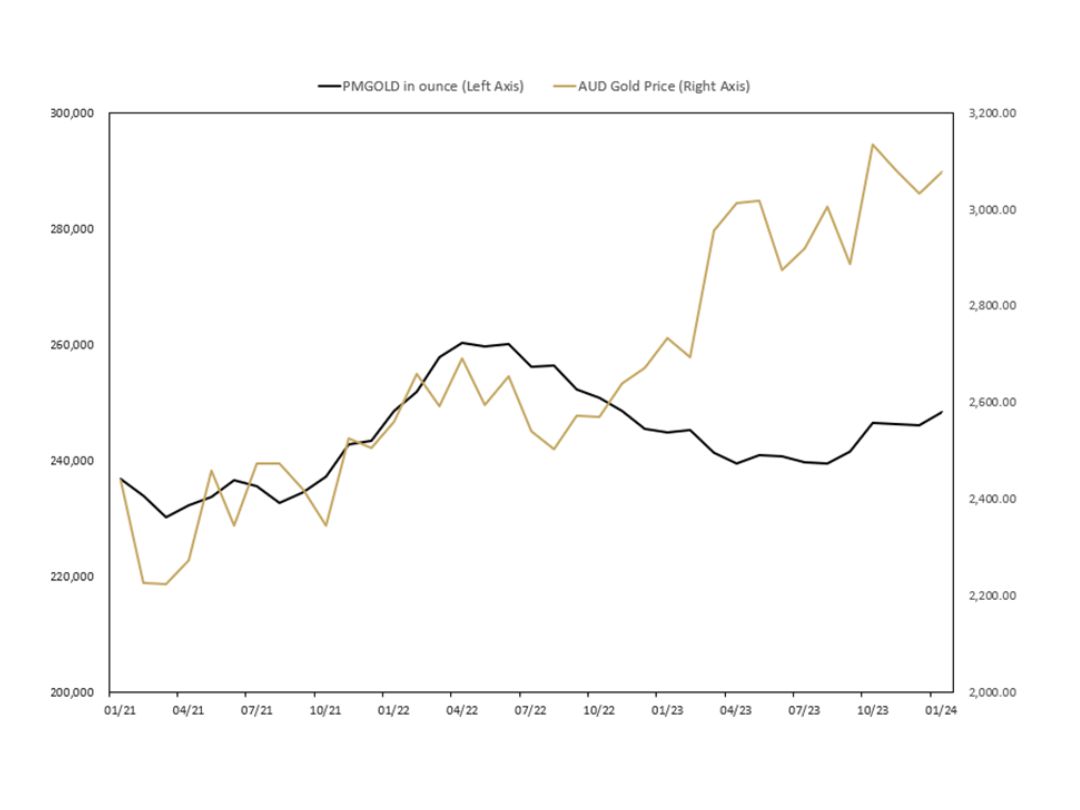

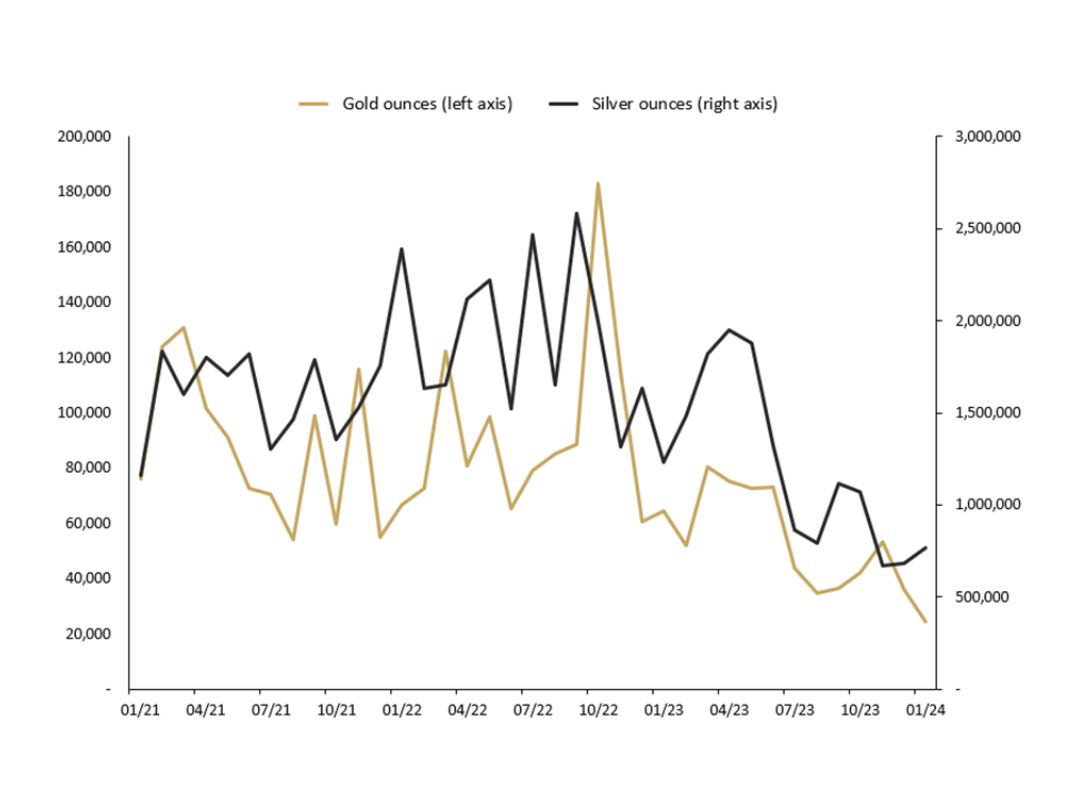

Perth Mint Gold (ASX:PMGOLD)

Perth Mint Gold is an exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD web page. PMGOLD webpage.

Total holdings in Perth Mint Gold (ASX:PMGOLD) increased during January, with holdings increasing by 2,199 oz (0.89%). This brings total holdings in PMGOLD to 248,315 ounces (7.72 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) January 2021 TO January 2024