Why these five gold misconceptions could reduce your investment return

It’s believed that the first gold coins were minted in the ancient Kingdom of Lydia, located in what is now part of western Turkey, around 550BC 1. These coins were stamped as a guarantee of their purity and weight and since then almost every government has minted gold coins for currency.

Over the past 2,000 years gold has continued its upward trajectory in terms of value and is still regarded as an item of wonder and beauty, whether that be as jewellery, collector coins or on the stock exchange as an exchange traded product (ETP).

Despite years as a trusted store of wealth, why is gold sometimes overlooked by investors?

During uncertain periods like the ongoing COVID-19 pandemic or as the Russian/Ukraine war rumbles on, diversifying portfolios has never been more important and the idea that gold may not help mitigate risk in portfolios is a misconception – a myth.

Cameron Alexander, Manager Business Development and Industry Research for The Perth Mint, says, “Myths are generally of unknown origin, widely held but have often originated from false beliefs or ideas. The financial markets attract many common myths, especially when it comes to the performance of particular assets over a set tenor.”

That’s why we’ve pulled together the five most common misconceptions held about investing in gold:

Myth 1 - Gold should not be included in portfolios, it’s too risky

In reality there may be short term volatility, but long term it’s a different matter. With a proven track record in either holding its value or rising when other assets fall, gold can be used to diversify portfolios to help risk adjusted returns (risk adjusted returns are a calculation of an investment's return by looking at how much risk is taken to obtain that return).

“Most investment assets see brief periods of elevated volatility, and gold is no exception, but over the longer-term, gold’s volatility is broadly in line with equities,” Cameron Alexander says.

The table below illustrates that from 1970 to 2020, gold’s volatility was in line with equities. This shows that even if investors had a 50/50 blend of gold and equities then gold could significantly reduce portfolio volatilities. The generally negative correlation to other traditional asset classes (stocks, bonds, cash and real estate) also demonstrates that gold is a ‘safe haven’ during political and market turbulence. But still, gold myths and misconceptions persist.

AUSTRALIAN EQUITIES AND GOLD 1970 TO 2020

Volatility

Best year

worst year

Gold

20%

206%

-36%

Equities

17%

86%

-42%

50/50 Blend

14%

135%

-31%

According to the World Gold Council, “Gold is a clear complement to stocks, bonds and alternative assets for well-balanced […] investor portfolios. As a store of wealth and a multi-faceted hedge, gold has outperformed many major asset classes while providing robust performance in both rising and falling markets.”3

With today’s uncertainty of market volatility and lower returns from traditional asset classes, the interest in gold is increasing. So, if you’re looking for a safe haven through diversification, gold may have a role to play in your portfolio.

Myth 2 – Investing in gold is only effective when inflation is high

“While gold has performed exceptionally well during periods of sustained inflation, it has also shown to provide stability and resilience during most economic and market conditions,” Cameron goes on to say.

Often, gold has been seen only as beneficial during periods of high inflation. The 1970s oil crisis was one such time that hit the global economy hard, triggering a stock market crash and sending inflation rates climbing. With markets in turmoil, gold rose from a low of USD35 per ounce in 1971 (set during the gold standard) to a peak of USD180 in late 1974. By 1976, however, the gold price fell nearly 40% to USD110 before gaining again in 1978 and then hitting an incredible USD850 in January 1980. 4

The World Gold Council, covering market data since the 1970s, found that gold has on average delivered gains of 15.1% (in nominal terms) and 8.3% in real terms in the years US CPI has averaged 3% or more.

Australian inflation and average gold price returns (%) 1971 to 2021

Inflation environment

Number of years inflation in this bracket

Average nominal gold return (%)

Less than 3%

27

3.6%

More than 3%

23

20.4%

Source: The Perth Mint, Australian Bureau of Statistics, World Gold Council

Myth 3 – Gold does not provide long-term portfolio returns

“Total returns include price performance coupled with dividends and interest payments, and while gold does not generate a yield, gold’s price performance can often deliver even healthier returns,” says Cameron.

Many advisors believe that gold does not provide long-term returns. But since 1971, when Nixon removed the US dollar from the gold standard, the dollar gold price increased 7.65% annually through to September 2019, meaning that this claim is just not true.

Although gold has not outperformed stocks and bonds during various market patterns, it has provided positive returns over a longer term, comparative to many other asset classes.

As you can see from the table below, adding gold to a hypothetical Australian pension fund portfolio over the last 15 years would have increased risk-adjusted returns. In fact, over the past 15 years, gold has risen by almost 210% 5/6

LONG TERM ANNUALISED RETURN UNTIL END OF 2021

Asset Class

1 Year

3 Year

5 Year

10 Year

15 Year

Gold in AUD

1.6%

11.2%

9.5%

5.3%

7.9%

ASX 200

17.2%

13.6%

9.8%

10.6%

6.2%

Cash

0.0%

0.6%

1.1%

1.9%

3.1%

Australian Bond

-3.3%

3.0%

3.5%

4.2%

5.4%

Australian Reits

21.6%

8.5%

4.7%

8.5%

-2.2%

Balanced Pension Diversified Fund Before Fees

11.1%

9.1%

7.5%

8.6%

6.3%

Myth 4 – Without paying interest or dividends gold has no value

“Despite not having a yield component, gold’s overall returns have broadly been in line with equity performance,” according to Cameron.

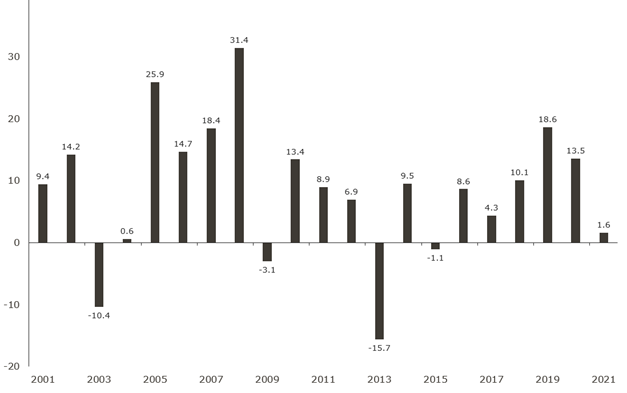

It is indeed true that gold doesn’t provide income like some stocks and bonds do, instead investors in gold are compensated solely by price appreciation, driven by economic and market trends. The chart below shows gold returns in AUD over the last 20 years.

GOLD’S ANNUAL RETURN IN AUD

Source: World Gold Council, The Perth Mint

Myth 5 – Only when the US dollar declines does gold appreciate

Cameron Alexander doesn’t agree completely. “A weaker US dollar can often be a catalyst for stronger gold prices, but this is not the sole driver for upwards movements in price. There are often other factors such as economic uncertainty, geopolitical turmoil and market volatility that can also drive gold prices higher at certain times.”

Although the US dollar and gold have had a long economic tie, when the gold standard was abolished by Nixon in 1971, central banks were no longer entitled to on-demand conversion of their dollars into gold, officially delinking gold’s price from the US dollar and allowing the price of gold to be influenced by open market demand, referred to as the Initial Public Offering (IPO) of gold.

Factors such as demand, interest rates, inflation, central bank reserves, production and market volatility can all influence the return on gold, pushing the price of the precious metal up as well as down. In January and February 2020, when the COVID pandemic was taking grip, the US dollar and gold actually rose in price, having a positive correlation.

But it’s not all about the US dollar. Gold also offers a de facto foreign currency exposure in an Australian investor’s portfolio, with declines in the value of the Australian dollar typically magnifying the gains gold delivers to local investors. In periods of financial market stress, not only does gold tend to go up, but the AUD often falls. GFC is a prime example of this; in 2008, when USD gold price was +4%, AUD gold was +28%.

Key takeaways

In the current volatile markets it could be the ideal time for financial advisors to change their stance on gold and whether it could be a worthwhile investment when thinking strategically about diversifying portfolios. By complementing current investments in bonds, stocks and broad-based portfolios, gold can hedge against currency depreciation and inflation, and has historically provided positive returns as well as offering liquidity in periods of market turbulence.

To find out more about investing in gold, visit: www.perthmint.com

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.