What are currency code standards?

Currency codes are the three-letter alphabetic codes that represent currencies used throughout the world.

Chances are you would be familiar with some major currency codes without explicitly knowing the mechanics of how they work – for instance ‘USD’ is the universally recognisable currency code for US dollars which is the base currency for foreign trade.

Every country-specific code has a corresponding three-digit numeric code which is identified by the International Organisation for Standardisation (ISO), a non-governmental organisation which provides standards for manufacturing, commerce, technology and communication.

Why are currency codes important to gold?

Modern markets trade by quoting prices in a range of currencies.

Currency prices are determined by supply and demand, meaning a higher USD price reflects a higher number of people buying it. Conversely, if demand for a currency, such as the Australian dollar (AUD), drops, those buying USD will get less in exchange for their AUD.

Currency codes are related to all markets and are especially relevant to gold as it is priced in USD.

However before currency codes were introduced, gold was the standard benchmark upon which all currencies were measured.

A brief history of the gold standard

The first system of currency was directly linked to the value of physical gold with countries agreeing to convert paper money into a fixed amount of the precious metal.

This made gold the initial base currency for world markets.

The development and formalisation of the gold standard began between 1696 and 1812 as the introduction of paper money posed problems. Yet it wasn’t until 1821 that England became the first country to officially adopt a gold standard.

The international gold standard emerged in 1871 following its adoption by Germany. By 1900, most developed nations were linked to the gold standard, the price of which was fixed in England.

Throughout this period all trade imbalances between nations were settled with gold, giving governments strong incentives to stockpile the precious metal for more difficult times. Many of those stockpiles still exist today.

However the gold standard was eventually abandoned in Britain in 1931, replaced with a fiat system. America followed suit in 1933 and by 1973 all remnants of the gold standard system had been dissolved.

With the value of currency no longer based on any physical commodity but instead allowed to fluctuate dynamically against other currencies on the foreign-exchange (forex) markets, a new way of delineating currencies was required.

Rather than currency value being pegged to gold, it was now globally measured against the USD after America emerged a global leader following World War II.

Hence in 1978 the ISO standard committees established standardised currency codes which are used to designate forex prices.

Currency code pairs

Each currency is assigned a three-letter code which is used in global markets. There are hundreds of currency codes however the most commonly traded and well-known are displayed below.

Currency code

Corresponding currency

USD

US dollars

AUD

Australian dollars

GBP

Great Britain pounds (sterling)

EUR

Euro

NZD

New Zealand dollars

CAD

Canadian dollars

JPY

Japanese Yen

CHF

Swiss francs

KRW

Korean won

Codes are determined by the ISO 3166 currency code and the type of currency. For example:

- USD – the US coming from the ISO 3166 country code and the D for dollar.

- CHF – the CH being the code for Switzerland in the ISO 3166 code and F for franc.

With foreign exchange markets trading off the USD, the USD is in many cases known as the base currency. It can be paired with a quote currency which is the currency it is being converted into.

Known as currency code pairs, these are used to determine how much money you can exchange for 1 USD.

For example, USDCAD is the currency pair used to convert 1 USD to Canadian dollars (CAD). This is known as a direct currency pairing and will tell you how much CAD is needed to buy 1 USD. Conversely, AUDUSD is the currency pair used to convert 1 AUD to USD. This is known as an indirect currency pair and will tell you how much 1 AUD will allow you to buy in USD.

This is important for gold traders as all commodities are measured against the USD.

Hence the price of the USD will impact the price you can get for the commodity you are trading, whether or not you are buying in USD or in other currencies.

In Australia, gold prices are quoted in AUD which is converted from the USD rate. This is done by calculating the gold price as quoted in USD by the AUD exchange rate.

It’s important to note that the price you pay for an ounce of physical gold will not be the direct conversion rate.

Buyers are also paying for fabrication and manufacturing costs and in many cases purchase and administration fees which are absorbed into the quoted price when buying from a retailer. Different margins apply depending on the product being bought.

This is known as the spot price.

Regardless of whether you are trading solely in AUD, CAD or any other currency, there is no denying the USD has direct impact on how gold is priced in modern markets.

Avenues of trade

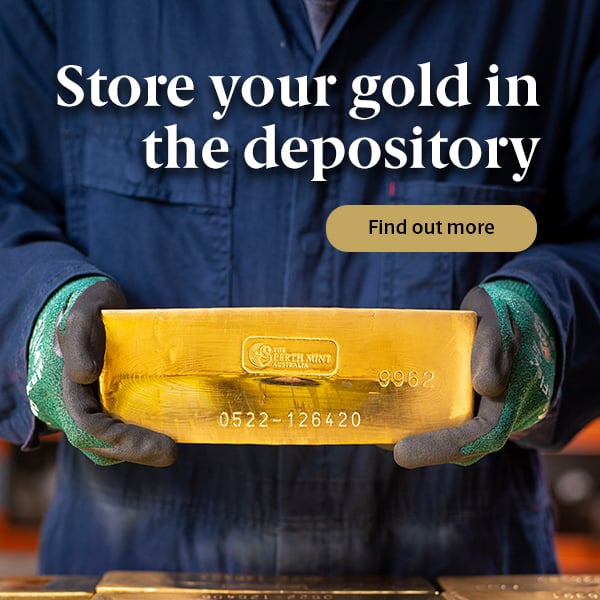

The Perth Mint has a dedicated trading desk manned by expert traders operating five days a week for over the phone trade via its Depository Program.

For those wanting the freedom to buy and sell 24/7, our Depository Online program offers just that.

Our GoldPass app is ideal for anyone comfortable with digital technology who wants to trade in gold through the convenience of their smartphone.

Alternatively, if you would prefer to invest via a brokerage account on the ASX, our ASX-listed Perth Mint Gold (PMGOLD) tracks the spot price of gold in AUD.

View our full range of investment options here.

Resources

ISO currency codes, ISO

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.