Investing in gold or investing in stocks?

When it comes to investing, the idea that you can forecast the market based on economic fundamentals no longer seems to apply.

How else can you explain the soaring US stock market when the country experienced its worst year for economic growth in 2020 since World War II? When social media speculators are flexing their meme muscles on shares and commodities? When valuations are even eclipsing those in the dotcom boom?

It’s been called a bubble , a yawning disconnect from reality and prompted headlines from publications not known to clutch their pearls — including the US Federal Reserve — that the market can’t be seen as a proxy for real life any longer.

The Australian market has also shown a gap between what’s happening in the broader economy and where investors believe they can make returns.

For some investors, it might feel pretty familiar: high prices defying the market bears, while the bulls bank the rewards, right until the moment when reality and markets meet.

But for those who have been on this roundabout before, it’s a reminder of why a diversified portfolio can help investors sleep better at night — and it’s one of the reasons why precious metals have recovered their shine.

Why diversify your portfolio?

The case for diversifying a portfolio can be hard to make when a market is in full run. If a stock portfolio is making strong, consistent returns, diverting funds into asset classes that are performing less strongly can create the sense you are not maximising your investment.

But in general terms, the value of diversifying as a way to reduce the risk of having all your eggs in one basket outweighs the opportunity cost.

Diversifying can act as a hedge against major declines in one asset, by picking one that is either countercyclical or that offers steady sustained returns regardless of headwinds in other sectors.

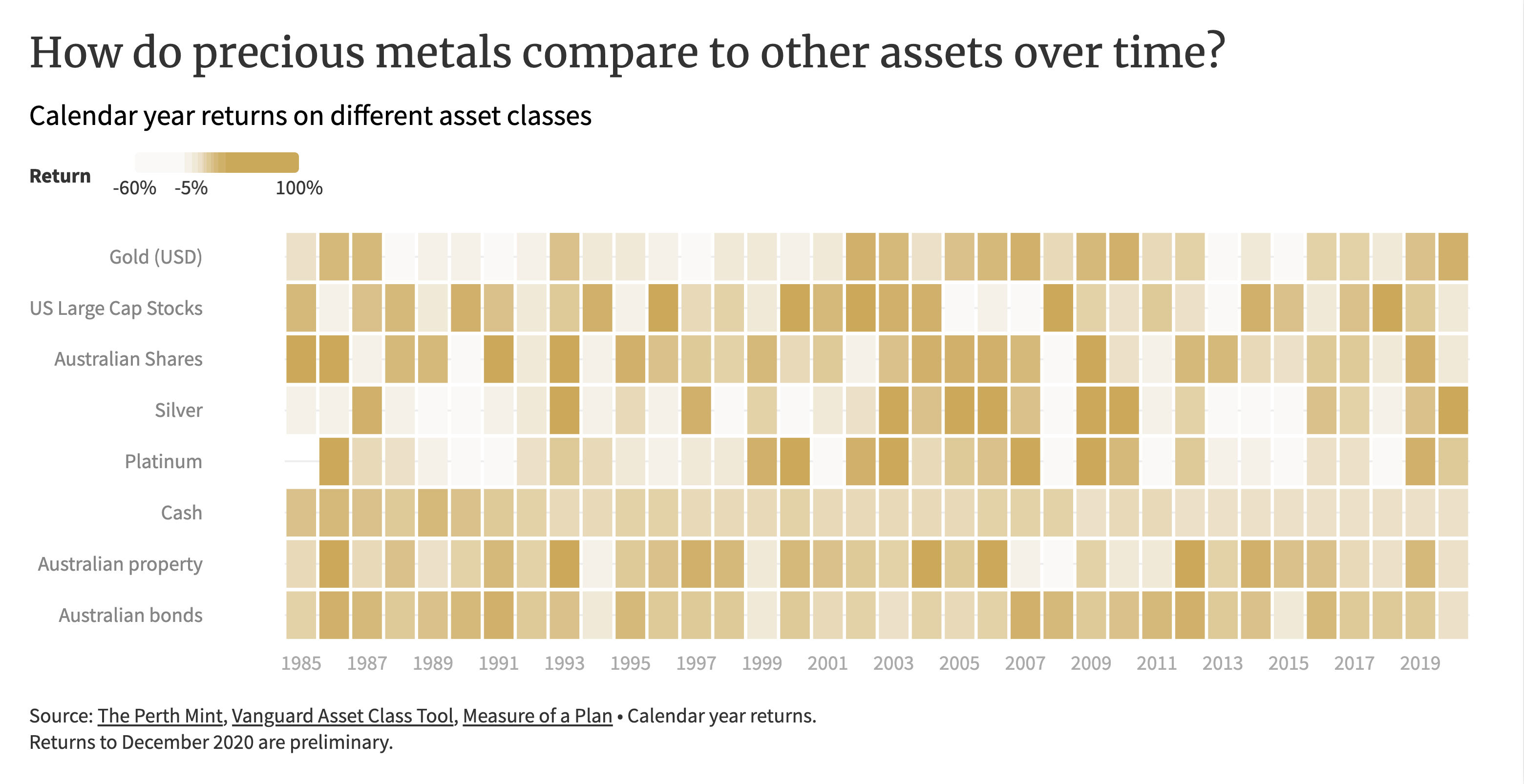

At the same time, diversification can be a growth strategy with the right mix of assets. It’s a rare year that sees falls in all major asset classes and some defensive asset classes show positive returns — however small — year on year.

The most defensive asset classes are so low risk that they deliver low returns, however.

Is gold a defensive asset?

As the primary precious metal used in diversification strategies, gold is both a defensive asset and a growth asset.

After all, it shares many of the characteristics with defensive assets like bonds. It has no maturity date, like perpetual bonds, and physical gold is a zero credit risk instrument, as there’s no risk of default.

There is also a historical link between US interest rates and the gold price, particularly when interest rates are seen as a proxy for economic resilience.

When real interest rates are falling, gold tends to be higher. When real interest rates climb, gold tends to decline. With interest rates in the US low for more than a decade, the relationship between real interest rates and gold can become obscured, but the price in USD bottomed in 2015 when the Federal Reserve raised rates for the first time since the Global Financial Crisis.

Last year, the Fed was signalling it expected rates to remain static for years to come as the US tries to manage its way out of the COVID-19 slump until inflation climbs up to 2%.

Even when rates rise, gold often performs well, as this is often a signal that inflation is climbing.

As the World Gold Council puts it: investors measure the relative attractiveness of gold by how much they can earn elsewhere.

Gold is also used by investors to hedge against extreme inflation. Work by Oxford Economics shows in periods of inflation up to 3%, gold returns in USD average 5.6%. When inflation exceeds 3%, average returns are 15%.

Another argument is the use of gold as a safer hedge than cash for investors when governments are printing money.

Quantitative easing is when central banks increase the supply of money in an economy as a form of stimulus. While it’s a popular measure that has become entrenched in some countries since the GFC, it risks having an impact on inflation and devaluing currencies.

According to a Kitco article, if the purchasing power of cash declines, gold provides additional comfort.

It is also an easy option for balancing foreign exchange risk. If an Australian investor with shares mostly in that currency buys unhedged gold, that can also provide portfolio protection in case the Australian dollar slides.

So as a defensive asset, gold has a lot of appeal, but it also can’t be discounted as a growth asset — particularly after topping major asset classes for returns in 2020.

Is gold a growth option for diversification?

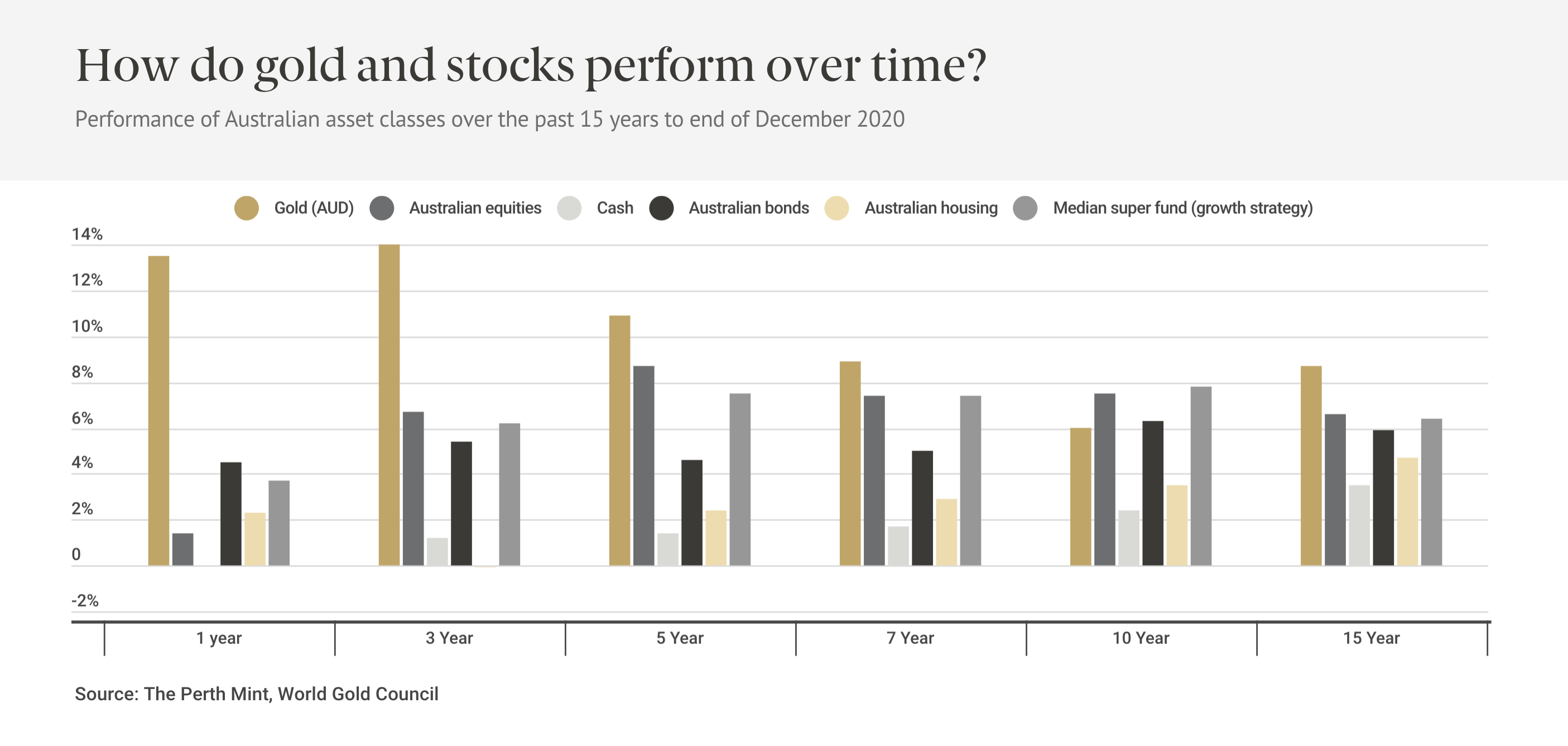

The strength of gold as part of a diversified portfolio can be seen in its long-term returns. Over the past 20 years, gold has outpaced a host of other asset classes.

Long-term investors have seen the gold price rise 551% (USD terms) and 454% (AUD terms) over the 20 years to the end of 2020.

Only four of those years have seen a fall in price (in either currency).

In the shorter term, gold has matched or exceeded other Australian assets, but it has also shown excellent performance in years when other assets are under stress.

In 2008 when Australian equities fell 40%, gold climbed 31% in AUD terms, for example. In 2011, when the ASX200 was down 11%, gold was up by 9%.

That countercyclical performance explains the role gold plays in boosting returns in a diversified portfolio.

The World Gold Council has calculated the role of gold in the average US investment portfolio, looking at the investment performance over five, 10 and 20 years. On that analysis, holding gold for between 2% and 10% of a portfolio boosts risk-adjusted returns over the long term.

Gold wasn’t being used just as a safe haven in the modelling either.

For a conservative portfolio, the modelling recommended 2.5% as the optimal gold holding. For a moderate portfolio, gold’s proportion grew to 5.6% and for an aggressive growth portfolio, nearly 10% was in gold.

How can you add gold to your investment portfolio?

The liquidity of gold makes it an easy asset class for investment — whether your preference is bullion bars and coins through to online options, exchange traded products or via a digital app.

The first starting point is to understand the options that work best for you.

You can find more information on the investment case for gold by downloading our SMSF Trustee Investment Whitepaper or explore your investment options here.

SOURCES:

https://www.washingtonpost.com/business/2021/01/28/gdp-2020-economy-recession/

https://www.ft.com/content/d424625f-6cff-4cd2-bb6a-ff95ec440899

https://www.gmo.com/australia/research-library/waiting-for-the-last-dance/

https://www.fa-mag.com/news/the-great-disconnect-59987.html

https://www.nytimes.com/2021/02/03/opinion/gamestop-stock-market-economy.html

https://www.afr.com/wealth/personal-finance/disconnect-between-market-and-economy-20200612-p55245

https://www.investors.com/research/gold-stocks-investing-price/

https://www.gold.org/sites/default/files/documents/gold-investor-201307.pdf

https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset-2020-individual

https://www.kitco.com/news/2021-01-27/Investors-should-move-out-of-record-cash-positions-and-into-gold-Brookville-Capital.html

https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset-2020-individual#chart7

https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset-2020-individual#chart8a

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.