Gold performs well whether equities are falling or rising

Gold is regarded as an effective hedge when equities fall. But there’s evidence showing gold can also be a good investment when the share market rises.

One reason many investors consider investing in gold is to hedge against volatility in the stock market. This is understandable, as history highlights gold’s ability to rise when the stock market falls, balancing out overall portfolio returns.

Looking back at the performance of gold and the local equity market at the beginning of 2020 demonstrates this point. The ASX 200 suffered an almost 30% decline in March that year as fears over the coronavirus pandemic and the measures taken to limit its spread caused a huge decline in economic activity.

During the same period, the price of gold in Australian dollars rallied more than 20%, helping to protect the portfolios of investors with an allocation to the precious metal.

The same happened in February 2022 as the war between Russia and Ukraine took hold. Gold prices rallied 6%, with silver, platinum and palladium prices also increasing, all while the S&P 500 headed down 3%.

50-year trend

The performance of gold during these times was not an anomaly.

Instead, it was a continuation of a trend that has been in place for 50 years, with gold typically serving as an excellent hedge against falling equity markets.

Indeed, historical studies highlight the fact that gold has typically outperformed all other asset classes in environments where stock markets have fallen fastest.

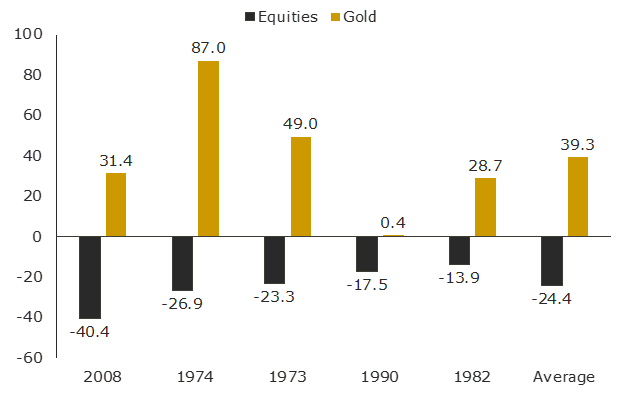

As evidence, consider the chart below showing returns from the Australian equity market (black columns) and gold (gold columns), during the five worst calendar years for equities between 1971 and 2020, as well as an average of the five years.

GOLD AND EQUITIES ANNUAL RETURNS (%) IN FIVE WORST CALENDAR YEARS FOR EQUITIES – 1971 TO 2021

Source: The Perth Mint, The World Gold Council, Reuters

The chart highlights that with the exception of 1990, when it was basically flat, gold delivered exceptionally strong gains in the years when equity markets suffered their largest falls.

The average annual increase for gold across these five calendar years was almost 40%, with the outperformance relative to shares topping 60%.

For those who owned gold as a hedge against falling equities through these periods, this would have made a profound difference to their overall portfolio return, as well as leaving them better positioned to capture the recovery in the market than those who were fully exposed to the downside.

Gold can also be effective when equities rise

Gold’s positive role is not limited to time periods where shares fall sharply. It may surprise, but gold can play a positive role in a portfolio in all market environments.

This table, below, which uses market data from 1971 to 2021 inclusive, reveals the average return for equities and for gold in the months, quarters and years when the equity market has risen, as well as when the equity market has fallen.

It shows that gold is positively correlated to rising equity markets, and negatively correlated to falling equity markets. More precisely, the table tells us that:

- The average gain for equities in the months when equities rose was +3.9%. In the same months, the average return on gold was +0.8%.

- The average loss on equities in the quarters when equities fell was -6.7%. In these same quarters, the average return on gold was +3.8%.

AVERAGE GOLD AND EQUITY RETURNS WHEN EQUITIES FALL AND WHEN EQUITIES RISE (%) – 1971 TO 2021

Equity market

Time period

Equities

Gold

Equities rising

Monthly

3.9

0.8

Quarterly

7.9

2.2

Yearly

22.2

10.5

Equities falling

Monthly

(3.6)

1.0

Quarterly

(6.7)

3.8

Yearly

(14.7)

15.7

Source: The Perth Mint, The World Gold Council, Investing.com

Key takeaways for gold investors

Fifty years of market data tells us that during periods when equity markets have rallied, gold has tended to rise too. When equities have declined, gold has also on average delivered positive returns.

Gold’s diversification qualities are particularly relevant today given the environment investors face, with historically low and in many cases negative real yields on traditional defensive asset classes like cash and government bonds.

These assets are unlikely to provide the same protective qualities that they did in the past, reinforcing the need for astute investors to look for alternative assets to protect and grow wealth in the years to come.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.