Gold or bitcoin – which one is the better investment?

It’s hard to think of an asset class that has generated more buzz in the last decade than bitcoin.

Marketed as 'digital gold', built using potentially revolutionary blockchain technology and launched in the aftermath of the Global Financial Crisis, the world's best-known cryptocurrency has risen from obscurity to front-page finance news.

This is no surprise given bitcoin's spectacular price growth, which saw it trade above USD 65,000 at one point in 2021.

Given this growth has coincided with a roughly decade long-period where gold priced in US dollars has been flat, some analysts claim bitcoin is replacing the precious metal, both as a safe haven asset and as a form of money itself.

While we are not anti- bitcoin per se, we think it’s far too early to claim it, or any other cryptocurrency for that matter, will replace gold.

We’ve addressed why this is the case in a detailed report, which compares the two asset classes based on six key issues:

- Market size.

- Liquidity.

- Investment costs.

- Volatility and drawdowns.

- Governance and regulation.

- ESG factors.

While bitcoin is generating lots of headlines, gold still holds the upper hand when looking at the above factors.

Risk versus return

The report also analyses the risk versus return for gold and bitcoin. It finds that while bitcoin offers more spectacular price growth, it also suffers from far greater volatility. Crucially, it also does not yet have a track record as a safe haven, and indeed typically underperforms equity markets in periods they are falling.

Gold on the other hand has an arguably unparalleled track record as a safe haven asset, both in periods of higher inflation (gold has averaged returns of approximately 15% p.a. in years inflation has averaged more than 3%), and in periods equity markets sell off.

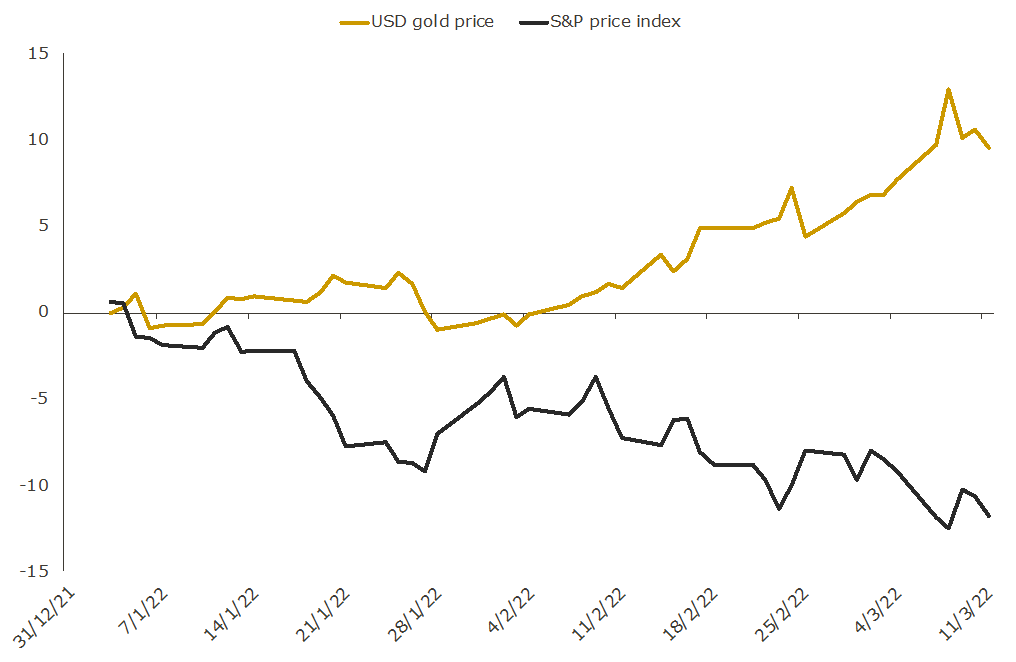

What we’ve seen in 2022 so far is a perfect example of this (see chart below), with gold priced in US dollars outperforming the US equity market by approximately 20%.

US dollar gold price and the S&P 500 price index YTD performance (%) to 11 March 2022

Source: The Perth Mint, MarketWatch, World Gold Council

This is in many ways a textbook example of gold providing portfolio protection when it’s needed most, and highlights why investors wanting to manage risk are likely to prefer holding the precious metal over bitcoin in their portfolios.

Questions must be answered

The report also highlights six key questions that in our view remain unanswered regarding bitcoin, including how decentralised it really is, and whether or not its fixed supply is actually a desirable trait in a monetary asset.

Competition is another factor to consider, with bitcoin losing market share in the cryptocurrency ecosystem over the last few years, while the law of diminishing returns practically guarantees that the spectacular performance bitcoin has delivered so far will not be repeated going forward.

The paper also looks at the ‘use cases’ for bitcoin, noting that while it can be used as an unregulated payment pipeline, a 2021 National Bureau of Economic Research Paper found that “90% of transaction volume on the bitcoin blockchain is not tied to economically meaningful activities”.

In other words, it’s overwhelmingly a tool for speculation and trading.

What on earth is a network effect?

A network effect is the phenomenon by which something (for example a social media platform or a search engine) becomes exponentially more valuable to each user as the userbase expands. The table below illustrates the phenomenon.

Network effects – telecommunications

# people with a telephone

# potential conversations

1

0

2

1

3

3

4

6

5

10

10

45

100

4950

Bitcoin advocates often refer to this concept, arguing that as the number of people who use bitcoin grows, so too must its price.

Investors may wish to question this.

To explain why, assume 12 school friends from the late 1990s all reconnected via a social media platform (SMP) last year, with one friend joining each month.

While the first 11 friends get to share a few more jokes in year one, the 12th friend gets the same utility upon joining, even though they connect last. Crucially, the experience of all the friends is improved by the 12th friend joining, strengthening the network effect of the SMP.

Now let’s assume that upon joining the SMP, each friend also bought USD 10,000 of bitcoin, with prices increasing from USD 5,000 to USD 60,000 in a linear fashion each month.

The table below highlights how much bitcoin each friend owns, and how much value they’d get from it if prices double after the 12th friend purchases.

Value of bitcoin investments for 12 friends – hypothetical example

Friend

bitcoin US dollar price at time of purchase

US dollar investment

Number of bitcoin bought

Current US dollar value of bitcoin investment

US dollar value if bitcoin doubles

#1

5,000

10,000

2.00

120,000

240,000

#2

10,000

10,000

1.00

60,000

120,000

#3

15,000

10,000

0.67

40,000

80,000

#4

20,000

10,000

0.50

30,000

60,000

#5

25,000

10,000

0.40

24,000

48,000

#6

30,000

10,000

0.33

20,000

40,000

#7

35,000

10,000

0.33

20,000

40,000

#8

40,000

10,000

0.25

15,000

30,000

#9

45,000

10,000

0.22

13,333

26,667

#10

50,000

10,000

0.20

12,000

24,000

#11

55,000

10,000

0.18

10,909

21,818

#12

60,000

10,000

0.17

10,000

20,000

When you consider that the primary use case for bitcoin is speculation, it is clear the 12 friends will not get the same utility from it in the way they do from their SMP accounts.

It’s also worth noting that in many cases, technologies that develop genuine network effects do so because they offer better value for money as the userbase expands.

As examples, consider that in the United States some studies suggest wireless telephone service charges have fallen by more than 50% in the last 25 years. A Reserve Bank of Australia paper in 2020 also suggested the measured price of mobile phone handsets had fallen by 18 per cent since mid-2015.

It’s much harder for something to build, let alone maintain a network effect, if the cost to each new user goes up.

Yet that’s exactly the hypothesis the bullish case for bitcoin is built upon.

Battle of the ages

While we see great risk in bitcoin, we do not agree with those who in our opinion oversimplify and call it a Ponzi scheme. We also think that it can co-exist with gold.

Indeed, given assets like gold and bitcoin only make up circa 3% of the total global financial asset pool (a far smaller percentage of levels seen in past decades), we would not be surprised to see both grow going forward.

It is also notable that while many see the gold versus bitcoin debate as a battle of the ages, with older people preferring gold, and younger investors preferring bitcoin, the reality is a little more nuanced.

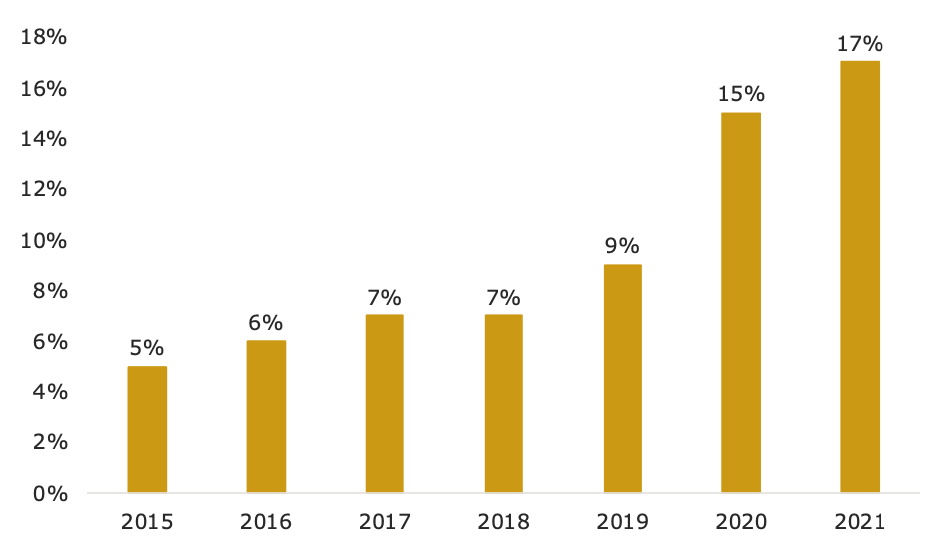

Indeed, data for our ETF Perth Mint Gold (ASX:PMGOLD) highlights the growth in the number of smaller investors, with the share of investors who own 100 PMGOLD or less rising from just 5% of the total shareholder base in 2015 to 17% by last year.

Chart: Share of investors in ASX:PMGold holding less than 100 pmgs

Source: The Perth Mint, Registry providers

Source: The Perth Mint, Registry providers

Given younger investors are by definition closer to the beginning of their wealth creation journey, with smaller pools of capital to invest, it stands to reason this growing cohort of smaller investors is skewed towards younger Australians.

Many may love bitcoin, but there is no evidence they are anti-gold.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.