Gold for financial advisors

Precious metal prices enjoyed another solid year in 2020, with the price of gold rising by more than 20% in US dollar (USD) terms, and approximately 14% in Australian dollar (AUD) terms.

The solid price increases, coupled with the unprecedented economic challenge posed by COVID-19, and the fiscal and monetary policy response to the pandemic, saw a huge uplift in investment demand for gold.

This was best seen through the rise of gold ETF holdings, which increased by more than 30% globally in 2020. Financial intermediaries working on behalf of Australian investors were very much at the forefront of this demand, with Perth Mint Gold (ASX:PMGOLD), for example, seeing inflows of approximately 70% in 2020, helping make the ETF one of the fastest growing products on the ASX.

Looking ahead, there remain no shortage of challenges for the global economy, which will obviously impact the investment environment. Some of these challenges include:

- Potential mutations of the COVID-19 virus and the logistical challenge of distributing vaccines globally

- Signs of excessive speculation in financial markets, from Bitcoin to Special Purpose Acquisition Vehicles (SPACs), to record levels of call option buying

- Record low real yields in many sovereign debt markets

- Questions regarding the evolution of fiscal and monetary policy, with developed market governments and central banks sovereigns having already deployed unprecedented levels of stimulus in the last 12 months

Given this backdrop, there remain solid reasons to look at incorporating an allocation to gold in a well-diversified portfolio.

Some of these include:

1. Outperformance when real interest rates are low

One factor motivating financial intermediaries to look at incorporating an allocation to gold in client portfolios is the ultra-low interest rate environment, which at this stage looks set to be a feature of the financial landscape for the next decade at least.

As a zero-yielding asset, the opportunity cost of investing in gold is significantly reduced, if not entirely eliminated in environments where real interest rates on cash and term deposits are negative in real terms.

Historically, gold has thrived in such environments, delivering average nominal gains of more than 20% per annum in years where real interest rates are 2% or lower.

2. Strong track record of protecting portfolios when equities sell off

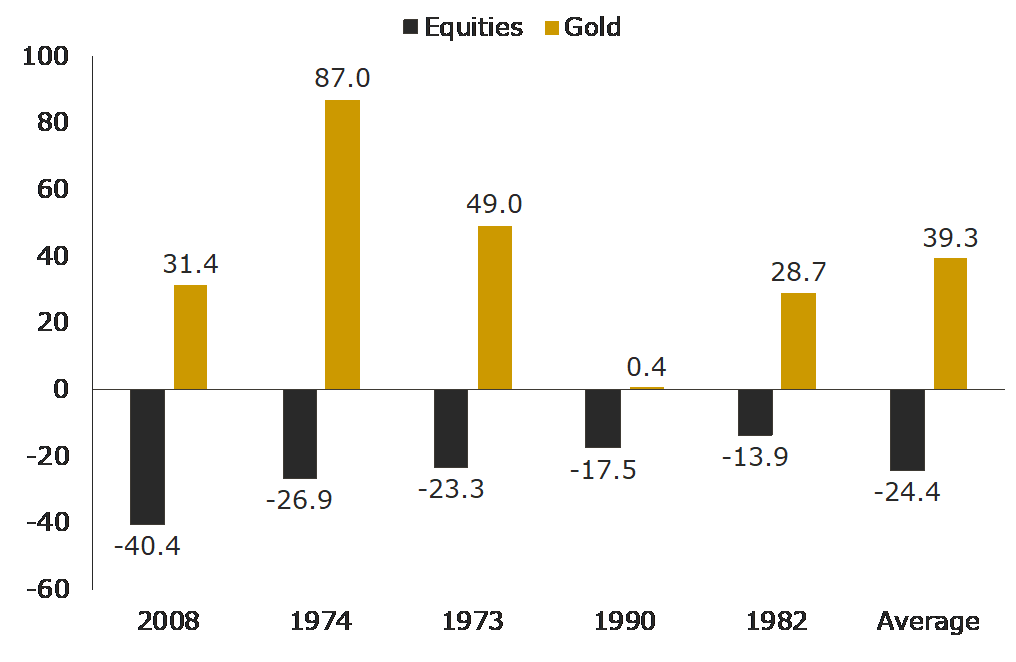

Gold has historically been the best performing single asset class in environments where equity markets sell off sharply, with allocations to the precious metal helping to mitigate overall portfolio drawdowns.

This can be seen in the chart below, which shows the performance of gold and of the Australian equity market, in the five worst calendar years for equities between 1971 and 2020, as well as an average across the five years.

Gold and equities annual returns (%) in five worst calendar years for equities – 1971 to 2020

Source: The Perth Mint, The World Gold Council, Reuters

Whilst the above chart uses calendar year data, analysis of the interplay between gold and equities on a monthly or quarterly basis demonstrates the same findings.

Gold’s historical ability to protect portfolio drawdowns may prove particularly attractive to investors in the years to come, given traditional defensive assets like cash and bonds offer such low, and in many cases negative, real returns.

3. Strong long-term returns

Over the last 15 years, the price of gold in Australian dollars has increased by almost 9% per annum, rising from less than AUD 700 to more than AUD 2,400 per troy ounce.

The precious metal has also outperformed most traditional asset classes and diversified investment strategies over this time period, as seen in the table below.

Australian asset class returns (% per annum) to end 2020

Asset class

1 year

3 year

5 year

7 year

10 year

15 year

Gold

13.5

14

10.9

8,9

6.0

8.7

Australian shares

1.4

6.7

8.7

7.4

7.5

6.6

Cash

0.2

1.2

1.4

1.7

2.4

3.5

Australian bonds

4.5

5.4

4.6

5

6.3

5.9

Australian housing

2.3

-0.2

2.4

3.9

3.5

4.7

Median superannuation fund (growth strategy)

3.7

6.2

7.5

7.4

7.8

6.4

Source: The Perth Mint, World Gold Council

4. Protection against any fall in the

Australian dollar

5. Simple and low-cost to incorporate into a portfolio

Analysis of all the ETPs trading on the ASX shows that the average management expense ratio (MER) of the more than 200 products available to retail investors was 0.50%, whilst the average trading spread in December 2020 was 0.25%.

By comparison, Perth Mint Gold (ASX:PMGOLD) has a MER of just 0.15%, and had trading spreads of just 0.08% in December 2020, with both of these costs less than one-third of the average costs for the broader ETF industry.

How to invest in gold

Most financial intermediaries typically look to invest in Perth Mint Gold (ASX:PMGOLD), which tracks the price of gold in Australian dollars.

More Information

To access more information on the investment case for gold, download our SMSF Trustee Investment Whitepaper

To find out more about Perth Mint Gold (ASX: PMGOLD), download our latest investment factsheet

To find out more about the various investment options The Perth Mint provides, visit our website

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.